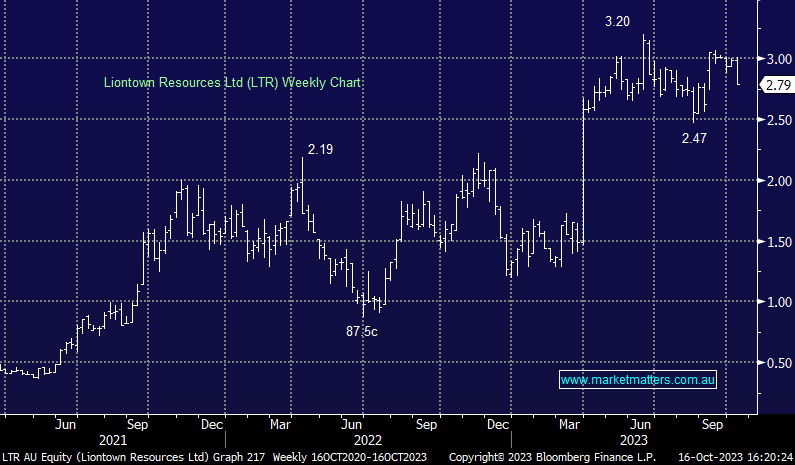

LTR Halted: now seems to be in a bit of a pickle after Albemarle walked away from a proposed $3/sh takeover bid due to ‘complexities’ that seem to revolve around Gina Rineheart’s recent move to buy 19.9% of the stock, throwing a potential spanner in the works for Albemarle. The issue now is around funding its Kathleen Valley Lithium project and the numbers are not small, they need about $1bn to reach first production (tipped for mid next year), and it now seems, given the extended trading halt, they’re in discussions with potential debt (and equity providers) to fund, what is now a rather large hole, although an amount ~$500m would do for now. This is a surprising move by Albemarle, they had made 3 other unsuccessful bids before $3 was backed in by the board – and now they’ve walked away. More water to go under the bridge here but LTR are out today garnering support for a raise, and brokers have taken the sword to their recommendations.

- Goldmans & Citi both now calling LTR a sell