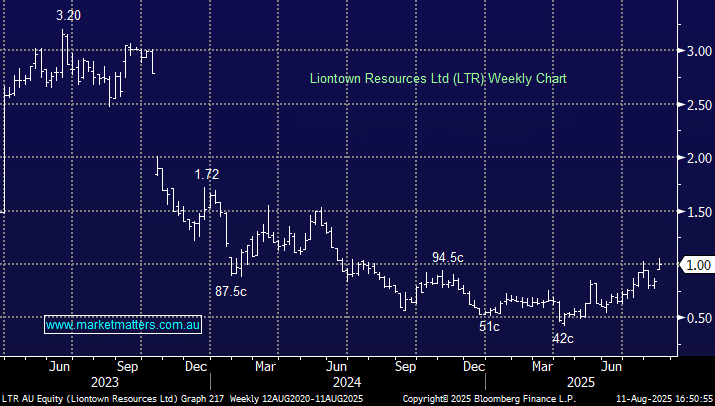

LTR’s production numbers were okay in July, though FY26 guidance left huge room for error: they forecast spodumene concentrate production for the full year of 365,000 to 450,000 dmt at an All in Sustaining Cost (AISC) of A$1,060 – 1,295 per dmt sold (dmt = dry metric tonne). This high cost producer needs lithium to extend its advance to turn the dial from a profitability perspective. The miner’s recent capital raise at 73c has strengthened the company’s balance sheet, with the Albanese government investing $50 million as part of the capital raise, marking its first equity stake in a critical minerals company.

- LTR is a highly leveraged play on a recovery in Lithium, and now with funding and support from the government, we see this as a turning point: MM holds LTR in our Emerging Companies Portfolio.