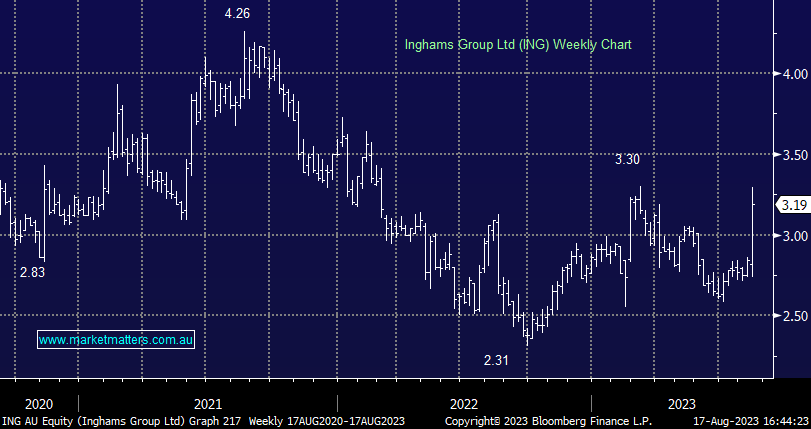

ING +14.75%: the poultry business hit ~5-month highs today after better expectations for FY23 and significantly de-gearing the balance sheet. Revenue of $3b was up 12% and in line with consensus, EBITDA up 14% to $434m was a small beat while NPAT of $71m was ~14% ahead of expectations. The strong second half was largely driven by better prices with Aus volumes slightly lower and NZ volumes a touch higher. Debt to EBTIDA at 1.4x was the big surprise with the market expecting a number closer to 2x today, likely to benefit cashflow given a lower interest expense as a result. The company didn’t provide any commentary for FY24 which is not unusual for Inghams.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

MM is neutral ING

Add To Hit List

Related Q&A

Your further thoughts on Helia Group (HLI) and Inghams (ING)

Your thoughts on Inghams (ING) and PEXA Group (PXA)

Ingham Group Ltd (ING)

Following up on Inghams Group (ING)

Why is Inghams (ING) still going backwards?

Thoughts on – CAJ, HLS & ING please?

Inghams (ING) view

Paladin (PDN) – is it a buy?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.