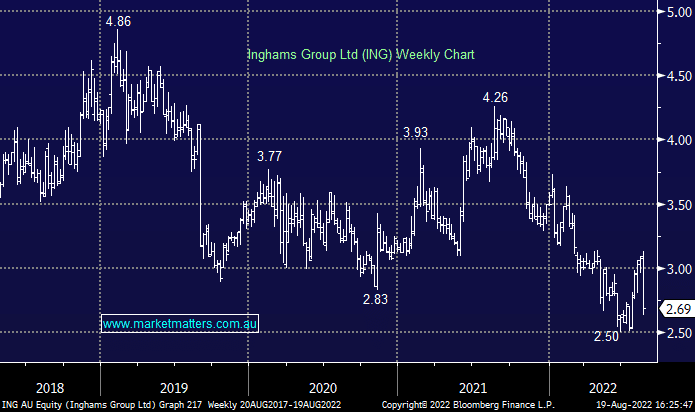

ING -9.43%: a difficult session for the poultry goods business that faced a difficult FY22. Profit fell nearly 60% to $35m, well below consensus at $43m despite volumes increasing more than 4%. Supply chain costs, COVID-absenteeism, weather and input cost inflation all weighed on the numbers. While these pressures have started to ease in the final quarter, the company said consensus expectations were too high for FY23 and they would expect downgrades of up to 10%.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral / negative ING ~$2.70

Add To Hit List

Related Q&A

Your further thoughts on Helia Group (HLI) and Inghams (ING)

Your thoughts on Inghams (ING) and PEXA Group (PXA)

Ingham Group Ltd (ING)

Following up on Inghams Group (ING)

Why is Inghams (ING) still going backwards?

Thoughts on – CAJ, HLS & ING please?

Inghams (ING) view

Paladin (PDN) – is it a buy?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.