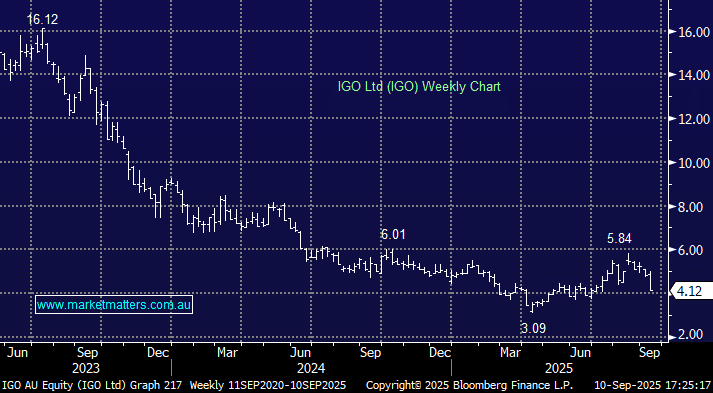

IGO tumbled 14% on Wednesday following the CATL news, one of four stocks to end the day down 14% or more. The company delivered a disappointing 4Q result, including weak lithium production and softer cash flow. However, its disappointing FY26 guidance, with the weaker-than-expected production guidance reflecting delays and ongoing ramp-up issues, makes the stock still feel too hard.

- We see IGO as a coin toss around $4 and believe PLS is a better trading vehicle on the lithium thematic.