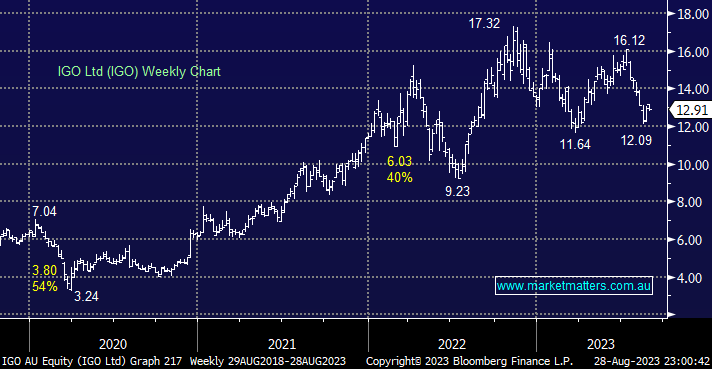

IGO has been under significant pressure over recent weeks after the company wrote down ~$1bn of Nickel assets only 12 months after purchasing Western Areas (WSA) i.e. its one thing to grow a business and another buy and integrate new assets. This is not a stock that we are ready to start accumulating but the risk/reward will start to look compelling into fresh 2023 lows. This is another miner with cost issues although their Tier 1 asset at Greenbushes warrants it – IGO is now being valued as a ~90% lithium and ~10% nickel miner.

- We like IGO into the current pullback although a dip towards $11 shouldn’t be discounted.