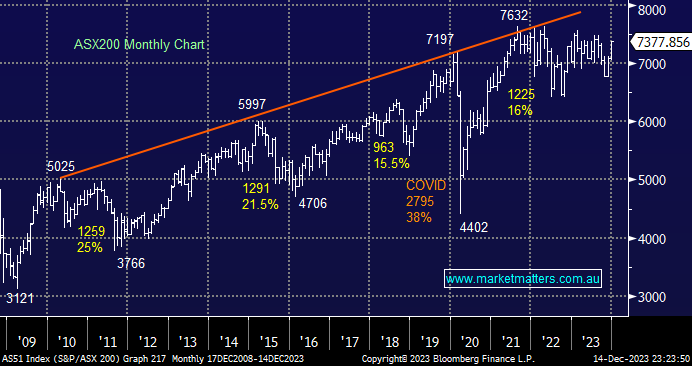

This week’s recent dovish tilt by the Fed has made us tweak our already bullish outlook higher; now, we wouldn’t be surprised to see the ASX200 make new all-time highs in 1Q of 2024 – Never say never! Ever since the GFC over 15 years ago, the ASX200 has been trending upwards with a few 15-20% corrections along the journey. Interest rates have been the main driver of valuations and sentiment during this time. We see no reason for this to change, i.e. stocks are in a sweet spot after the Fed’s comments on Wednesday night, but as the previous German Bund chart illustrated, we are already well into the pullback in yields MM has been flagging over the last few months.

We wear a couple of hats as we write reports and manage money in MM Invest (and via Bespoke Portfolio Management for wholesale investors via Shaw & Partners), but our core focus remains the same for all, to add value to portfolios, whether driven by ourselves or self-directed by subscribers. So far, our portfolios have performed strongly in 2023 as we’ve largely kept on top of the stock/sector rotation. as bond yields called the shots:

For context, the ASX 200 Accumulation Index (large caps) is now up 9.12% since January 1st while the Small Ordinaries Accumulation Index (small caps) is up 4.47%

- Active Growth Portfolio: CY23 to date, the portfolio has increased by 19.3%

- Active Income Portfolio: CY23 to date, the Portfolio has increased by 8.16% (with less than 60% exposure to equities)

- Emerging Companies Portfolio: CY23 to date, the Portfolio has increased by 7.96%.

- International Equities Portfolio: CY23 to date, the Portfolio has increased by 26.78%

NB These numbers are from 1/1/23 to 14/12/23 for the published (website) Market Matters Portfolio’s.

Many investors focus far too closely on the index as opposed to the underlying stocks and sectors. To put things into perspective, just four stocks make up almost 30% of the ASX200, i.e., in order of weighting, BHP Group (BHP), Commonwealth Bank (CBA), CSL Ltd (CSL) and National Australia Bank (NAB) – if we added the other banks it would be over 40%. Hence, it wouldn’t be hard to call the index perfectly, but if a portfolio were skewed incorrectly, it would underperform the broad index significantly.

- We can see the ASX200 making a new high into 1H 2024 with trendline resistance still over 8% away.

When we say “never say never”, almost a James Bond title, the “Magnificent Seven” not surprisingly come to mind, with the NYSE FANG+ index posting new all-time highs this week; it’s more than doubled since late 2022. However, as investors, we must remain open-minded and look ahead as opposed to in the rearview mirror, and we believe the risk/reward with regard to US tech is now leaning in favour of profit-taking.

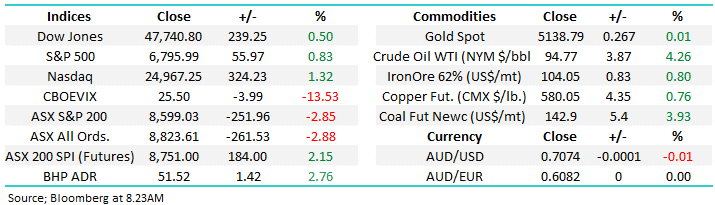

The overnight action in the Market Matters International Equity Portfolio spoke to this theme, with the likes of Brunswick (BC US) +7.6%, Freeport-McMoran (FCX US) +7.09%, First Solar (FSLR US) +7.98% & Blackstone (BX US) +7.28% versus the likes of Microsoft (MSFT US)-2.25% and Chipotle Mexican Grill (CMG US) -2.75%.

- We believe the US tech advance is maturing fast, and the sector will underperform in 2024.

With regard to how far the ASX200 can advance over the coming months, we only need a handle on the banks and heavyweight miners to form a well-informed opinion.