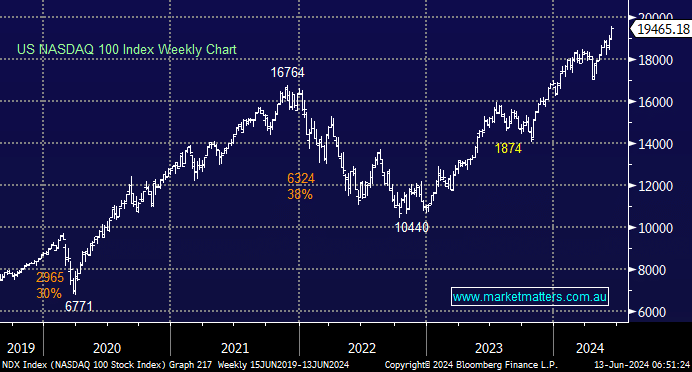

The US Tech Sector again led the broad market up to fresh all-time highs, with Apple (AAPL US) and Nvidia (NVDA US) both catching the eye, advancing +2.9% and +3.6%, respectively. The Feds news wasn’t great overnight, but all they really did was continue to “kick the can down the road”. Five rate cuts by Christmas 2025 will still deliver a large tailwind for equities over the next 18 months. We are now adopting a “wait and see” approach to US stocks as they approach our initial target area.

Our newest position, Zillow Group ( ZG US) in the International Equities Portfolio, enjoyed a great night, surging over 12%, on the news that director Jay Hoag bought 2,338,036 shares, around $100m of stock – a very different market reaction to director selling in the likes of Boss Energy (BOE).

- We have been targeting US stocks’ current breakout to new highs; now it’s time to see if it can extend the move.

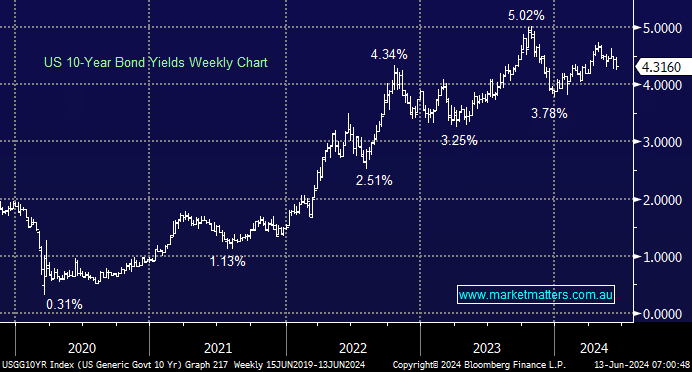

Last nights, CPI and Fed commentary was net bullish for bonds and bearish towards yields, with the 10s starting to edge back towards 4%. One number doesn’t change the economic landscape, but investors want to believe the Feds successfully reined in inflation and rate cuts will follow. Hence, a few more encouraging pieces of economic data and markets are likely to jump on the bandwagon of lower rates.

- We expect the US 10s to test ~3.5% over the coming 1-2 years.