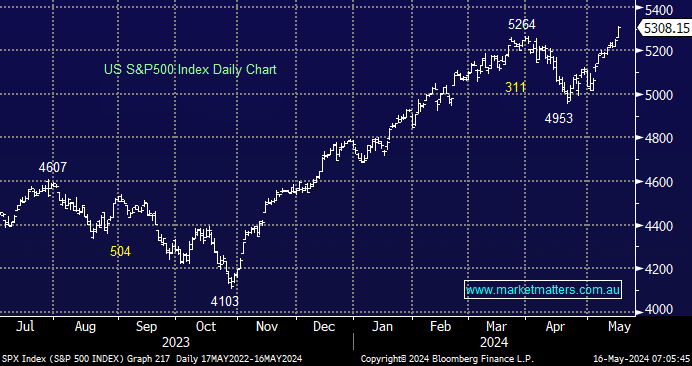

US stocks closed at fresh all-time highs overnight as markets again focused on the Fed’s two or three rate cuts in the next 9-12 months. We can see the current bullish sentiment lasting for at least a few months as stocks continue to demonstrate the path of least resistance is on the upside. However, we strongly believe this is increasingly becoming a stock pickers market as valuations slowly stretch on the upside, right up our street at MM.

- We are targeting the 5500 over the coming weeks/months by the S&P500.

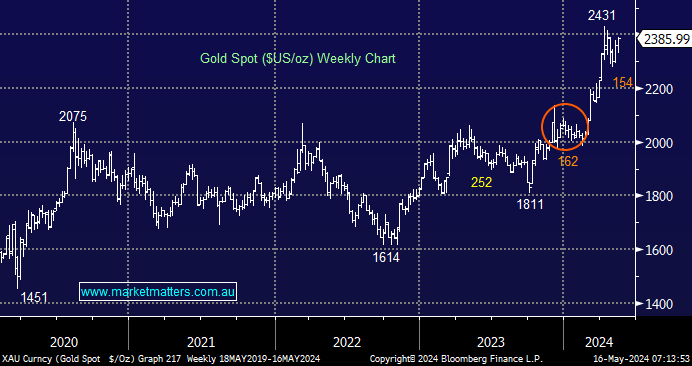

Gold popped ~$US35 overnight, taking it within striking distance of its April all-time high. Lower bond yields and a falling $US provide a strong tailwind for precious metals, a backdrop that looks set to at least continue over the coming months. We believe gold and equities will form a swing high around the same time, but for now, we believe both have further to travel on the upside before MM will consider edging down the “risk curve”.

- We are targeting the $US2500-2550 area in the coming months for gold before it takes a well-deserved “rest”.