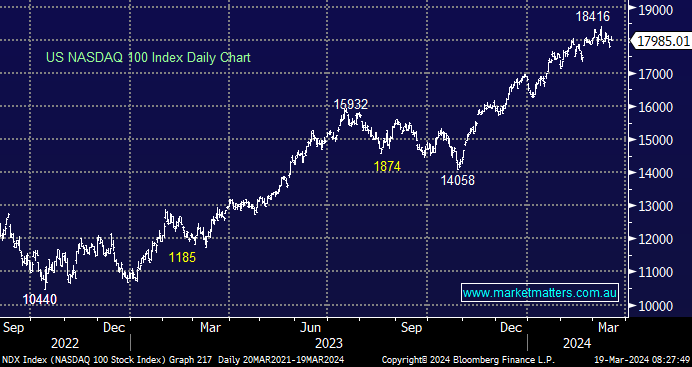

US stocks advanced last night as the influential tech sector found some buying after a few weak sessions. Outside of GOOGL/AAPL mentioned earlier, we also saw Meta Platforms (META US), Netflix (NFLX US), and Tesla (TSLA US) advance over 2%, with the volatile car maker putting on over 6%.

- The NASDAQ remains around all-time highs, but we’re mindful that a more hawkish FOMC outcome on Wednesday could slow the market’s advance.

Crude oil edged to fresh 2024 highs overnight following attacks on Russian energy facilities and yesterday’s encouraging Chinese data. The combination of news painted an improved picture for both the demand and supply sides of the equation. If we see further signs of an improving Chinese economy over the coming months, oil could quickly test its recent resistance area, i.e., a more bullish scenario than we have been expecting through 2024 due to supply concerns.

- No change; crude oil has been range bound for over 18 months with major support around $US70/barrel and resistance below $US100, a wide band.