US indices ended mixed overnight, with the S&P500 edging lower while the NASDAQ finished higher. Recently, the markets have been showing some short-term buyer fatigue after November’s stellar rally. However, we still anticipate higher prices in the coming weeks. Falling bond yields overnight weren’t enough to lift the broad market as apathy appeared prevalent with Christmas now only 19 days away – the Energy Sector offset gains by tech, falling over 1% as Brent Crude tested $US77/barrel and new 4-month lows.

- We continue to target at least fresh 2023 highs for the S&P500; now, we are only one good day away.

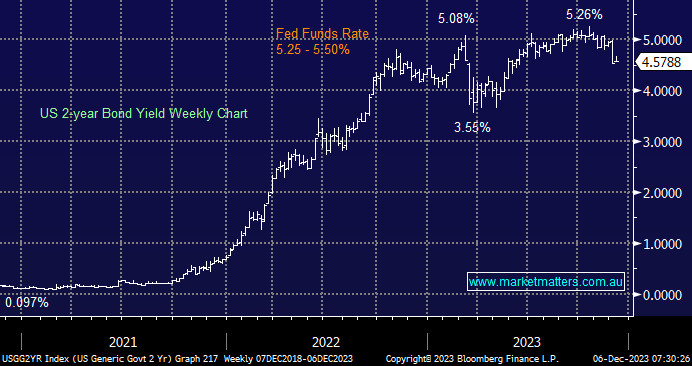

Bonds resumed their recent advance (yields lower) after weak jobs data fuelled speculation that the Fed will be forced to cut interest rates next year to avert a recession – job openings hit their lowest level since March 2021. The longer-dated 10s joined an advance in global bonds, with one of the most hawkish ECB officials stating that inflation is showing a “remarkable” slowdown – the big “R” word might be the next thing to spook markets, i.e. Recession.

- No change; we are targeting a test of 4% by US 2-year bond yields.