US stocks ended mixed overnight after struggling for much of the session following a strong GDP print-reduced slightly optimism for rate cuts through 2024. However, yields still ended the session lower – the US economy grew at a 5.2% seasonally adjusted annual rate in the third quarter, above estimations of 5%. The Financials and Real Estate Sectors led the gains, with Tech starting to look noticeably tired after its stellar advance over the last 12-months.

- We remain bullish on US equities, initially targeting fresh 2023 highs into Christmas, but there’s no big call as it’s now less than 1% away.

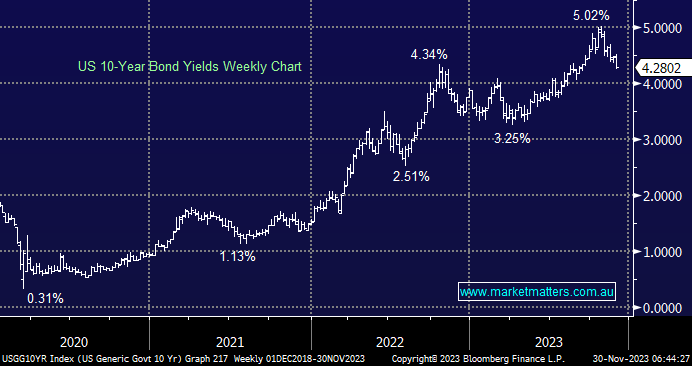

US bond yields continue to decline even in the face of a strong CPI, an excellent sign for the doves like MM. The influential US 10-years traded below 4.25% overnight after breaking above 5% earlier in the month; recent more dovish comments by Fed members have more influence than economic data. The rally driving global bonds to their best month since the GFC gained further traction overnight as traders increased wagers towards rate cuts in 2024, i.e. we are in the Goldilocks Scenario as the economy experiences a painless measured slowdown. This move by bonds has fuelled the advance by equities to one of their best Novembers in history.

- We are still targeting a break below 4% for the important 10s over the coming months.