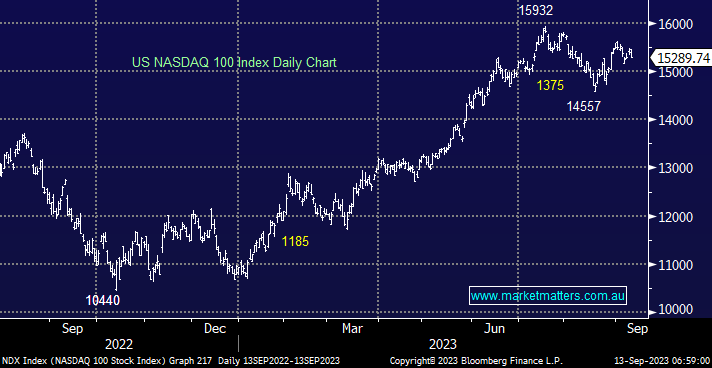

US indices fell overnight as nerves set in ahead of tonight’s CPI data, the rate sensitive technology companies led the declines falling -1.1% with Apples unveiling of the new iPhone 15 not exciting investors with the iconic stock falling -1.7%. Software supplier Oracle Corp (ORCL US) plunged over 13%, the most since 2002 following a slowdown in cloud sales. On a positive note, the Energy Sector closed up +2.3% after crude oil traded to levels not seen since January 2022 with the psychological $US100/bbl getting closer by the day.

- No change; we believe US stocks are now heading to fresh 2023 highs led by tech, still less than 4% away.

- However, it should be noted that we do believe the rally by tech since Q4 of 2022 is maturing, and we wouldn’t be chasing a breakout above 16,000.

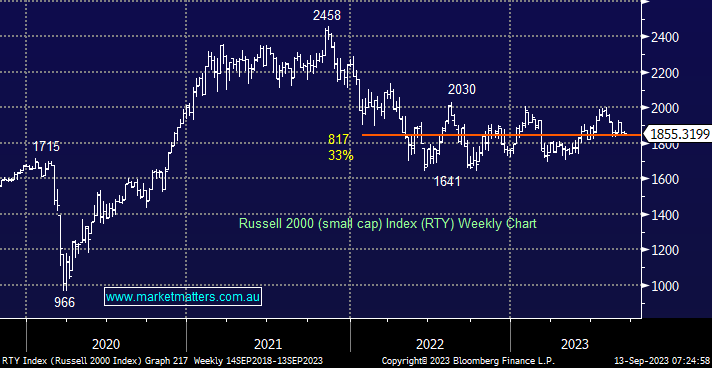

Interestingly in line with this year’s stock/sector rotational theme the small caps actually closed higher overnight even while the major indices slipped lower, another illustration that until further notice adding value/alpha is about what pockets of the stock market investors carry exposure as opposed to whether they are invested.

- We can see the Russell 2000 making new swing lows into 2024 as the space fails to embrace any bullish market sentiment.