The Market Matters Global Macro ETF Portfolio Tracks our top 10 global macro calls, and provide avenues to trade them via ASX and internationally listed Exchange Traded Funds (ETF’s) – Click here to view

MM’s Global Macro ETF Portfolio fell 0.57% in a fairly quiet week which saw no positions moving by 3% or more.

No change, this is portfolio which is largely positioned in accordance with our views across financial markets, we are only holding 5% in cash and the ETF we are primarily looking to buy finally corrected, its feeling like a good place to “dip our toe in the water”:

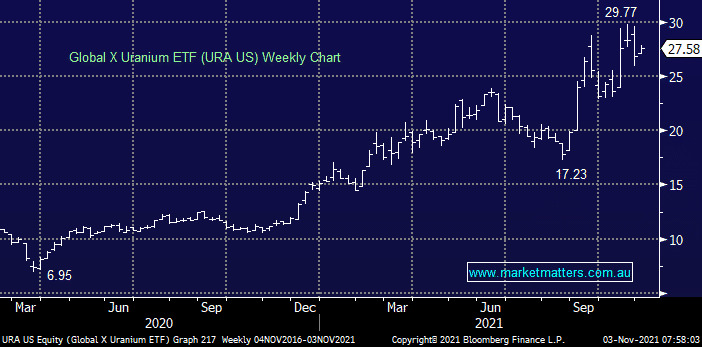

- Buy – the US traded URA ETF, we like this uranium ETF which looks to track companies involved in both mining and production of nuclear components.

- Sell – our ProShares Short 20+ Year Treasury ETF (TBF US) has not delivered as the weakness was focused in the short-end of the curve – frustrating but the reason for the position has gone for now.

- Sell – our ProShares Ultra Euro (ULE US) is not performing yet and we will be giving this more time but it’s definitely on watch.