What Matters Today in Markets: Listen Here each morning

Wednesday saw the ASX200 enjoy a reversal of fortunes at 11.30 am when the Australian February CPI came in at 6.8%, well below both market expectations and last month’s 7.4%, the big question now is will this be enough for Philip Lowe et al at the RBA to refrain from hiking interest rates next Tuesday. At MM we’ve sat on the dovish side of the equation for months believing the economy’s underbelly was more fragile than previous data would suggest and our view is the RBA should and will refrain from hiking next week.

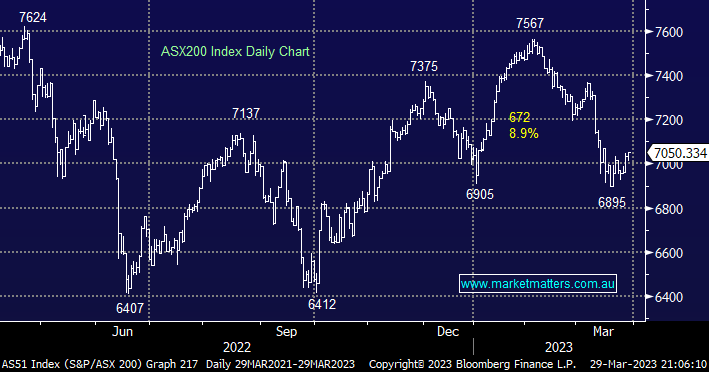

- The market’s pricing is no more rate hikes from the current 3.6%, this should prove supportive of stocks if correct but in today’s volatile & nervous market, a lot can happen in 5 days!

The market-friendly inflation print reversed earlier stock market losses to take the local index up +0.25% led by ongoing strength in the Resources Sector while selling in the banks courtesy of UBS’s downgrade was enough to restrain gains on a day when surprisingly there were more losers than winners. The growth stocks in Australia continue to underperform their US peers and even with the increasing likelihood of no further rate hikes the healthcare and IT stocks delivered mixed performance on Wednesday – we still see 6-8% upside from the US NASDAQ hence we are sticking with our overweight call on the sector locally.

US stocks rallied overnight sending the Dow up over 300 points as investors went in search of more risk/return sending banks and tech stocks higher, this Thursday’s US inflation data is likely to determine whether we can see some follow-through on the last few week’s rallies. The NASDAQ is set to deliver its best quarter since 2020 illustrating the point we made earlier. It was a quiet session in commodities but the strength in equities was enough to send the VIX to its lowest close in 3 weeks. Following the S&P500’s +1.4% rally the SPI Futures are pointing to a 50-point gain by the ASX200 this morning with tech the likely standout ably supported by BHP which rallied ~1% in the US.

- The ASX 200 will likely reach our short-term ~7100 target this morning, from a technical & risk/reward perspective, a close above 7200 is required to get us bullish again.