The ASX200 kicks off the infamous May this morning having already enjoyed gains of 6.6% year-to-date with the Banking Sector leading the way following the sharp rise in global bond yields in Q1. Conversely the local sector which has struggled noticeably in 2021 is IT where the higher yields might have some investors questioning the elevated valuations of some of these tech stocks i.e. value stocks have finally been enjoying some outperformance compared to growth this year.

We believe that the path for stocks, sectors & indices this year will continue to be dictated by the markets perception of bond yields moving towards 2022, and beyond – a common phenomenon. Last week the Australian inflation data remained extremely supportive for risk assets:

- The Australian CPI rose +0.6% in the March 2021 quarter, with the important core inflation coming in at 0.3% – both significantly below expectations.

- Unemployment continues to fall in Australia but wages pressure hasn’t yet flowed through to the economy in a meaningful manner hence no worrisome rise by inflation.

If inflation pressures remain subdued the RBA’s goal to keep interest rates anchored to 0.1% is looking realistic although I caution a lot can happen in 3-years, nobody had heard of COVID two years ago, let alone three! The RBA have said repeatedly they won’t increase rates until “actual inflation is sustainably within the 2% to 3% target range” – last weeks numbers has the current annual rate at just 1.1%.

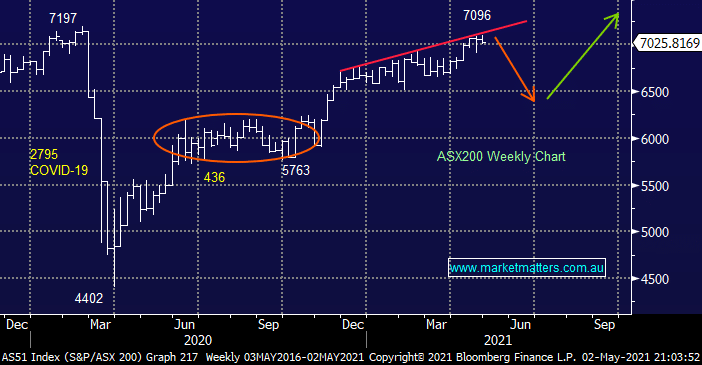

So with Australia’s economy throwing up no surprises at this stage I can understand why some subscribers might doubt our call that a pullback is feeling a strong possibility but remember the market looks at least 6-months ahead. Fundamentally we are questioning if the current post COVID economic backdrop is justifying the local equity market trading around its all-time highs, we believe situations such as India & Japan are illustrating that the risks moving forward should not be discounted to zero.

Fridays saw some weakness in the US tech large cap stocks but the SPI futures weren’t concerned on Saturday morning as they closed down less than 10-points, a good result by Westpac (WBC) this morning should help the local market.