What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

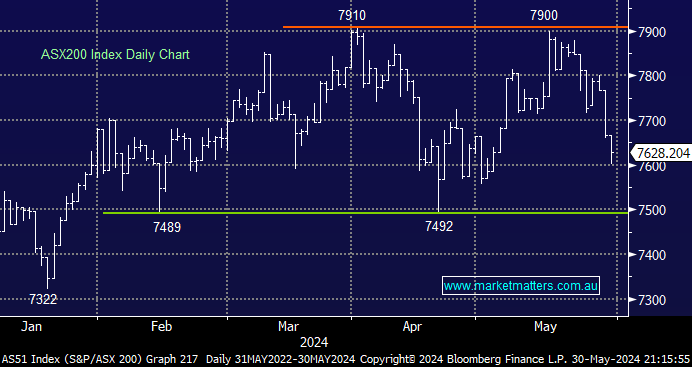

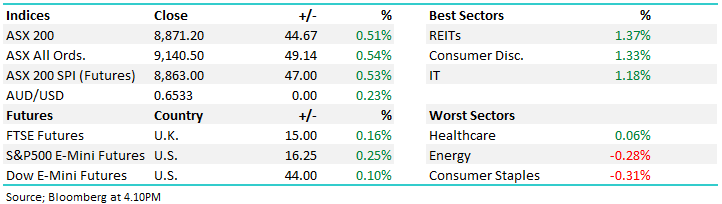

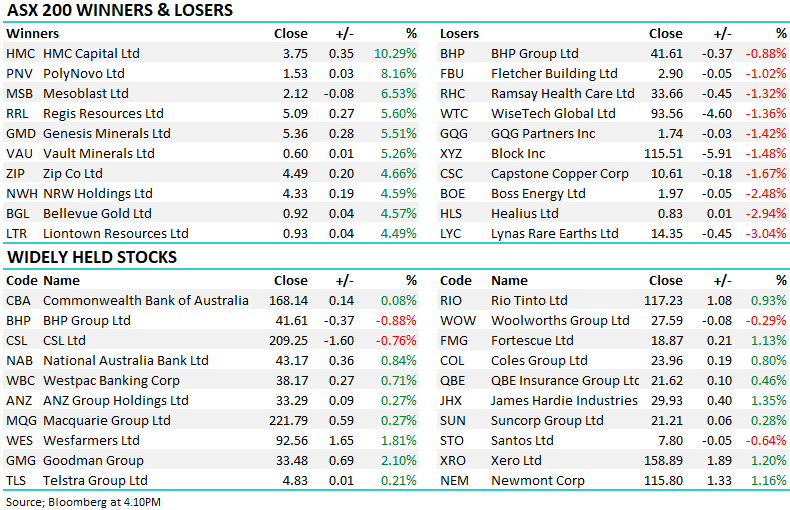

The ASX200 continued its downward spiral, falling another 0.5% on Thursday. Five of the 11 sectors managed to close higher, including positive performances by the Consumer Discretionary, Healthcare, and IT names—not what purists would expect when a market was being weighed down by concerns around interest rates. Conversely, fairly aggressive profit-taking in the previously “Hot” gold and copper names led the Materials Sector down -1.9%:

Winners: Cochlear (CH) +1.7%, Super Retail (SUL) +1.2%, Xero (XRO) +1%, CAR Group (CAR) +1%, Lovisa (LOV) +0.9%, JB Hi-Fi (JBH) +0.8%, and ResMed (RMD) +0.3%.

Losers: Regis Resources (RRL) -6.5%, Sandfire (SFR) -5.1%, Fortescue (FMG) -3.1%, Gold Road Resources (GOR) -3%, Iluka (ILU) -2.9%, Evolution (EVN) -2.8%, and Newmont (NEM) -2.2%.

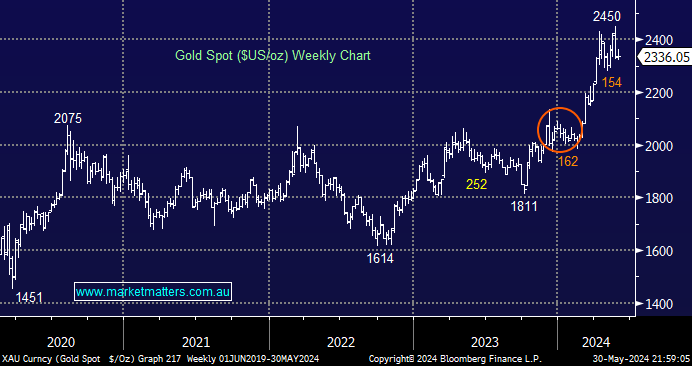

In this particular instance, after identifying a pullback was likely, MM decided to hold our overweight exposure to gold and copper, believing in the longer-term trend. We are Active Investors as opposed to traders. However, this sharp pullback across these two previously “hot commodities” illustrates how a little well-timed tweaking around the edges of a portfolio can add alpha (performance) by the year’s end – we just need to get it right!

The local market has fallen 300 points over the last fortnight and local bond yields have moved up 25bps, but it was finally refreshing to see some bargain-hunting surface throughout the day, eroding over 40% of the early losses. We’re not breaking out the bunting just yet, but some investors appear to be accumulating out-of-favour stocks/sectors into the current weakness, although it’s clearly at the expense of some profit-taking in the market’s top performers.

US stocks finished lower again overnight, with the NASDAQ falling over 1%. A disappointing outlook from Salesforce (CRM US) knocked 20% off the stock, triggering a wider sell-off in tech, with Microsoft (MSFT US) -3.4% and Nvidia (NVDA US) -3.8% catching the eye. Bond yields pulled back as both US GDP and the Feds preferred measure on inflation, Core PCE, came in below expectations. New York Federal Reserve President John Williams’s said, “Inflation is still too high, but he is confident it will start decelerating later this year.”

- This morning, the SPI Futures are pointing to a surprisingly strong open up +0.6%, which suggests some overseas buying is about to roll through our market.

This morning, we quickly reviewed three lesser-discussed gold stocks as the sector’s pullback gathers momentum. As medium–term bulls, we are looking at levels to potentially start increasing our exposure to the sector. Remember, this is a sector that’s likely to witness plenty of M&A activity over the coming year. For example, this week, Ramelius (RMS) made a play for Westgold (WGX).

- Our ideal roadmap for Gold is the precious metal will find support into weakness under $US2,300