What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

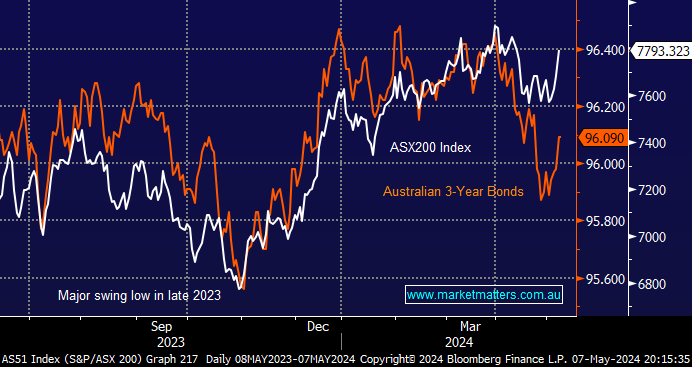

Earnings undoubtedly drive share prices over the medium/long term, but when it comes to sharp short-term swings in overall market valuations/sentiment, there’s nothing like monetary policy to dictate terms for stocks, with the RBA front and centre yesterday. The correlation between the local index and 3-year bonds has been extremely close over the last year, which is the major reason MM keeps a close eye on credit markets. The RBA left interest rates unchanged on Wednesday at 4.35%, while they indicated rates would need to “stay higher for longer” to rein in sticky inflation; importantly, there was little suggestion that rates would again start to rise as many had feared. The main pressure on inflation is coming from the strong jobs market, as well as higher petrol prices, which has a knock-on effect throughout the economy – the latter is frustrating when we consider crude oil has fallen 5% in 2024.

Both MM and the market found some snippets of the RBA commentary very encouraging regarding the likely future path for interest rates. They may remain at 4.35% into Christmas, but another rate hike is looking far less likely after yesterday’s RBA press conference and the market-friendly comments from the Fed last week, which were complemented by Friday’s “goldilocks” employment data. The RBA is understandably going to remain data dependent, but they’re still leaning toward the next move being a cut:

- “Recent data indicate that, while inflation is easing, it is doing so more slowly than previously expected, and it remains high”

- “The board expects that it will be some time yet before inflation is sustainably in the target range and will remain vigilant to upside risks.”

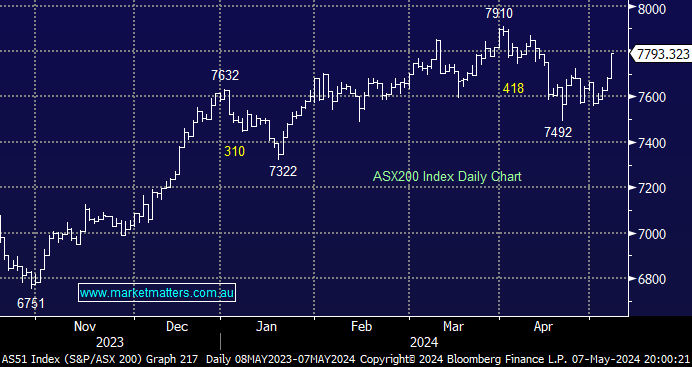

If stocks and bonds continue to follow the MM roadmap, both will break above this year’s highs through 2024/5, although we caution that equities are already starting to factor in lower rates moving forward. As we said earlier in the week, “Our “best guess” is the market will advance 6-8% from current levels“, which will take the ASX200 up to the 8200 area, although we caution that not all stocks/sectors will move as one.

- We continue to believe the next move by the RBA will be a rate cut, although it may not arrive until 2025.

The ASX200 enjoyed its strongest day in three months on Tuesday, courtesy of a less hawkish RBA. The index closed up +1.4%, with around half of the day’s advance unfolding after the RBA’s 2.30 pm announcement. All 11 sectors rallied on the news, with Consumer Staples, which is regarded as a defensive sector, the worst performer. However, it still advanced over +1% in a day of broad-based buying across the local market which saw over 90% of the main board close higher. It’s been a choppy few months, but the numbers don’t lie, and despite rising bond yields and Middle East conflict, the ASX200 is only 1.5% below its all-time high; as we often say, a market that can rally on “bad news” is a strong one.

When we consider our bullish stance towards the major pockets of the market, solid reporting season home and abroad, and the rapidly improving macro backdrop for equities, we see no reason that yesterday’s bullish momentum cannot run further, especially following April’s ~5% washout by local stocks, which has left many nervous investors sitting on the sidelines.

- Technically, we believe the local market is “off to the races”, and a test/break of 8000 is likely over the coming weeks.

- This morning, the SPI Futures are pointing to an initial +0.2% gain following a quiet session on Wall Street.