What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

Last week’s Bank of Americas Fund Managers Survey showed the market is the most bullish in over two years on the back of the biggest jump in global growth optimism since May 2022 – allocations to stocks and commodities hit a 27-month high, at the expense of bonds, with cash levels falling to 4.2% from 4.4% in the previous month – just shy of the sub-4% level that traditionally signals a contrarian sell indicator for equities according to the BofA Global FMS Cash Rule. Conversely, an increasing number of fund managers now believe gold is the most overpriced since COVID. The most crowded trade recognized by fund managers continues to be the “Long Magnificent 7.” Overall, last week was not the best time for Fund managers!

- Stocks endured a tough week, with geopolitical tensions rising in the Middle East and the market losing confidence that the Fed and other central banks will meaningfully cut interest rates in 2024.

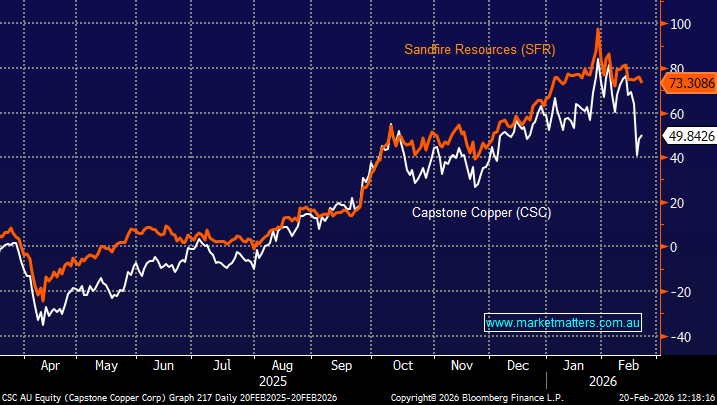

- Last week, only the bullish commodities call delivered for fund managers, with copper remaining front and centre. It rallied another +5.6%, again posting multi-month highs.

- However, Friday delivered a different story. Aggressive selling washed through the Big-cap Tech stocks ahead of their earnings, while the Dow, FTSE, and US Small Caps all rallied nicely.

The severity of the selling, which hit the “Magnificent Seven” at the end of last week, was bordering on panic in places, with Nvidia (NVDA US) -10%, Netflix (NFLX US) -9.1%, and Meta Platforms (META US) -4.1% catching our attention. The timing couldn’t be more intriguing for the Tech Sector; with the market battling major macro headwinds, it is walking into earnings reports next week from Microsoft (MSFT US), Meta Platforms (META US), Alphabet (GOOGL US) and Tesla Inc (TSLA US) right after the NASDAQ posted its largest weekly fall since November 2022, i.e. investors are long and nervous.

- We believe the current sell-off by the quality tech names is a buying opportunity.

Most of us have heard of “Buy on the rumour, sell on fact,” which is potentially a looming problem for the Mag. Seven, they are forecast to increase profits by +38% last quarter compared to 12 months ago, according to Bloomberg, trumping the S&P500, which is only expected to grow earnings by +2.4%. The clear issue is that expectations are high, and the market is long, leaving plenty of room for disappointment. Around 35% of the S&P500 will report earnings this week, and as scepticism seeps into the market, volatility is almost guaranteed.

- Tesla reports on Tuesday after the market, Meta Platforms on Wednesday, and Microsoft and Alphabet on Thursday.

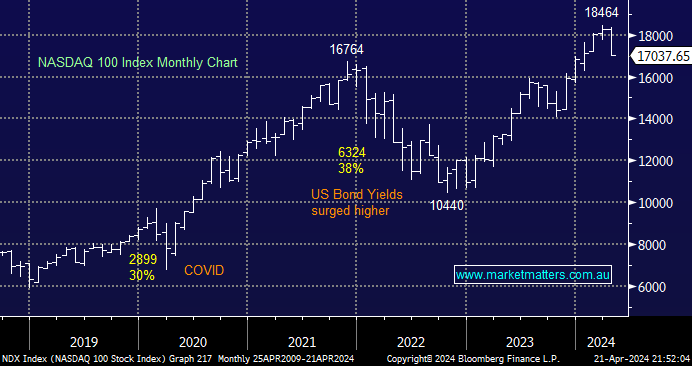

The Tech Sector will react to earnings, but its correlation to bond yields should not be ignored. Weak bonds and higher yields are bad for tech, as we saw in 2022, but the opposite is also true. Investors have enjoyed dovish credit markets, which have largely focused on rate cuts into this Christmas. If they lose faith that central banks have inflation under control, the recent 7.7% pullback could extend significantly – not our preferred scenario.