What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

Overnight, the influential former Federal Bank of St. Louis President James Bullard said he’s expecting three rate cuts in 2024 as inflation moves towards the Feds target even while the economy remains resilient, i.e. the “Goldilocks” scenario for stocks. Bullard’s outlook echoed the Fed’s messaging as opposed to the increasing market expectations that two cuts have become more likely than three, e.g. Treasury yields made new highs for the year on Monday night. Mr Bullard is indirectly quoting the old adage of “don’t fight the Fed”:

- “At this point, you should probably take the committee and chair at face value — their best guess right now is still three cuts this year,” Bullard said in a Bloomberg TV interview on Tuesday.

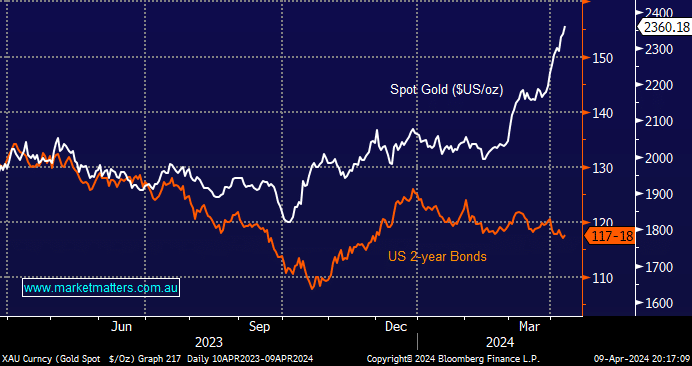

However, it wasn’t the ongoing commentary from the central banker that caught our attention but rather the market’s reaction following the relatively Dovish interview—gold surged over $US30 to another all-time high while bond yields hardly moved. This has been the story of 2024, which has seen gold surge around $US300/oz while bonds have drifted lower (yields higher). The reactions were an extension of a recent market characteristic we looked at on Monday:

- We believe gold will outperform bonds in the foreseeable future but both look good over the coming 1-2 years.

The closer the market gets to pricing in two cuts this year, the more likely we can see bonds and rate-sensitive stocks pop on the upside. Over recent months, we felt the risks lay with the Hawks because the market was priced for perfection, i.e., the futures market was fully pricing in three rate cuts. This equilibrium is now slowly reversing, as the market is “fighting the Fed” or betting against the Fed’s rhetoric, historically a dangerous game.

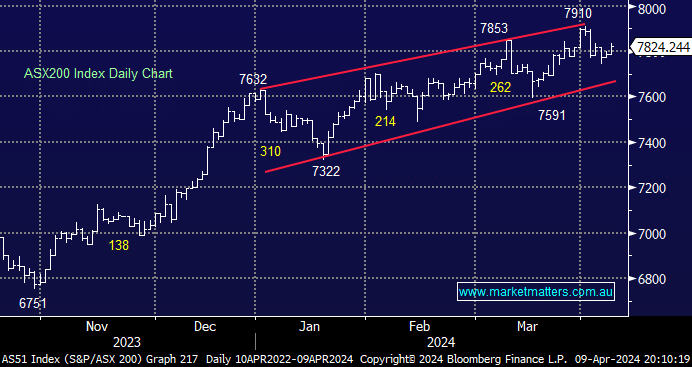

The ASX200 enjoyed a solid session on Tuesday, closing up +0.45%, back within striking distance of its all-time high posted in February. The miners drove the index higher, with a number that we looked at on Tuesday providing the backbone of the market’s 35-point advance. The standout examples were BHP Group (BHP) and RIO Tinto (RIO), which contributed more than 50% of the market’s advance. Elsewhere, the banks remained firm with the “Big Four” advancing ahead of the attractive dividends due from ANZ, NAB and WBC next month.

- If we are correct and bonds eventually turn higher in 2024 (i.e. yields lower), plus the Resource Sector remains strong, we will see the ASX200 breach the psychological 8000 sooner rather than later.

We remain bullish on equities, but our view that stock and sector rotation is the key to outperformance through 2024 is our main focus. Hence, subscribers will likely see more alerts over the coming months as we tweak our portfolios, looking to add value/alpha. Importantly, we expect to remain committed to the miners through 2024, believing the sector can enjoy significantly more upside as the outperformance baton gets passed around the various commodities, i.e. can coal and lithium again catch investors’ attention following the substantial gains by copper, gold and uranium stocks over recent months.

- This morning, the SPI Futures are pointing to a firm opening, up 24-points, taking the index back towards 7850 – another 50c gain by BHP in the US is set to be very supportive.