What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

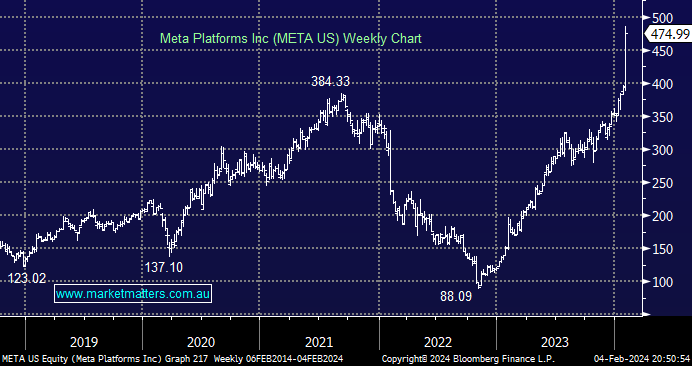

Last week saw the US S&P500 close at its 4th consecutive fresh weekly high on strong tech earnings and a solid jobs report on Friday, illustrating the underlying strength of the American economy. Bond yields had driven equities post-COVID, but US earnings season became the new driving factor last week, no real surprise by the baton change on the stock level, but the moves have been extraordinary, propelling US indices higher, e.g. Facebook-parent Meta’s +20% surge on Friday made Zuckerburg over $US28bn in one day, a rare move for a stock of this magnitude but we did see NVIDIA (NVDA US) pop over +24% last May, i.e. the “Magnificent Seven are still a rule unto themselves at this stage.

It is not often the crowd gets so well rewarded, but as last month’s Bank Of America Fund Managers Survey told us, the large-cap US tech stocks were the most crowded place to be invested; so far, so good!

- US equities continue to focus on the positive as we saw them last week shrug off Jerome Powell taking a March rate cut off the table and yields surging higher following Friday’s Jobs Report, e.g. high yields usually weigh on stocks.

Social Media giant Meta Platforms surged after their results beat analysts’ expectations, and they announced the company’s first-ever quarterly dividend plus a $US50bn share buyback program, i.e. a greater than the entire market cap of Macquarie Group (MQG). Of the “Magnificent Seven,” last week we saw Meta Platforms (META US), NVIDIA (NVDA US), Amazon.com (AMZN US), Alphabet (GOOGL US), and Microsoft (MSFT US) all make fresh all-time highs while Apple Inc (AAPL US) and Tesla (TSLA US) struggled, plus Alphabet (GOOGL US) had reversed lower come Friday, in other words, its become the “Dominant Four”, not traditional broad-based buying but its proving hard to fight the tape at this stage.

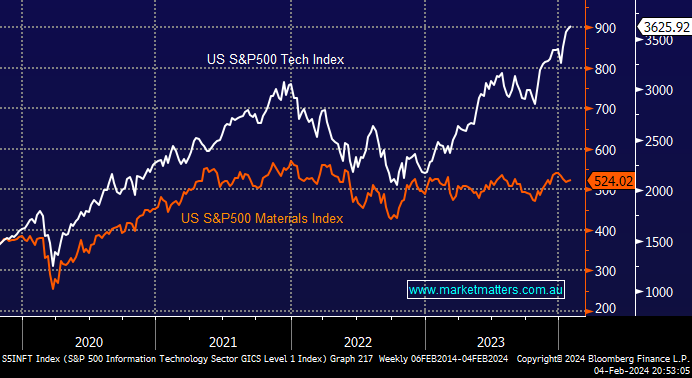

As discussed earlier, four stocks propelled the S&P500 to fresh all-time highs last week, whereas a firming $US and lack of belief that Beijing can meaningfully turn China’s economy around led to the elastic band between the Tech and Materials sector stretching even further, it will snap one day, but the million dollar question remains when!

- We have been looking for outperformance from the US Tech Sector to reverse in 1Q of 2024, but there are no signs yet.