There was a very good quote on Bloomberg this morning with direct relevance when thinking about portfolio construction: “Knowledge is knowing a tomato is a fruit. Wisdom is not putting it in a fruit salad” – Winston Churchill.

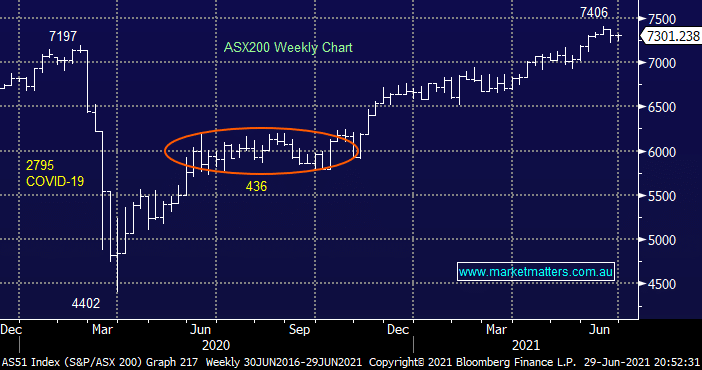

The ASX200 fell early yesterday only to recover virtually all of the losses after midday to close down just 0.1% – how many times have we written that in the last 12-months! Almost 50% of the Australian population being thrown back into a COVID lockdown has been taken in its stride by the local market illustrating the inherent buying into any weakness. Investors are clearly still fairly cashed-up and optimistic. The markets likely to get another test on Thursday / Friday as fund managers will be far less reticent to sell after the EOFY rule off but it feels like we need a new meaningful catalyst to get the bears to venture back out of their caves.

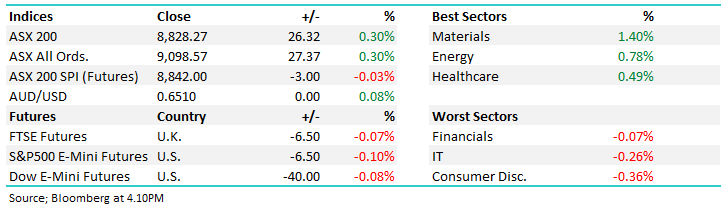

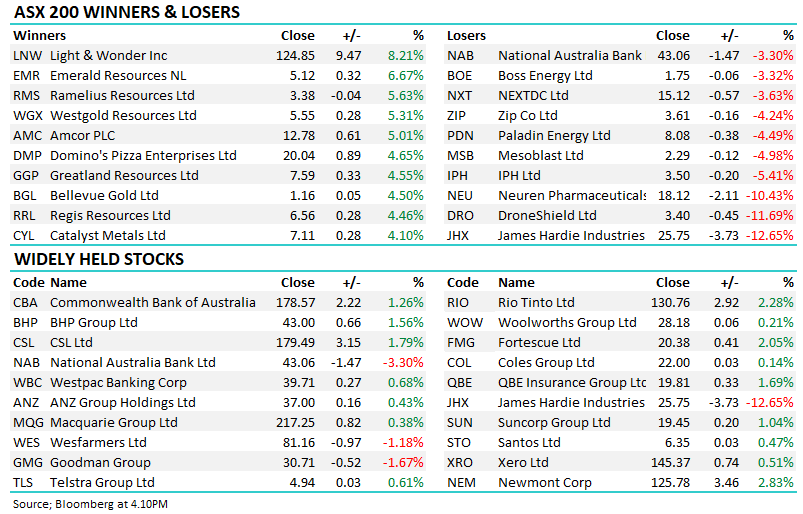

Come 4pm the story was fairly similar to Monday under the hood with less than 40% of stocks rallying but gains by Commonwealth Bank (CBA) and CSL Ltd (CSL) proving enough to largely offset the broader weakness. The ASX feels like it’s been in a holding pattern through June as it weighs up a few influential economic factors:

- The $US has bounced strongly in June questioning if the resources stocks can continue their post COVID outperformance into Christmas e.g. BHP Group (BHP) has pulled back 12% from its mid-May high.

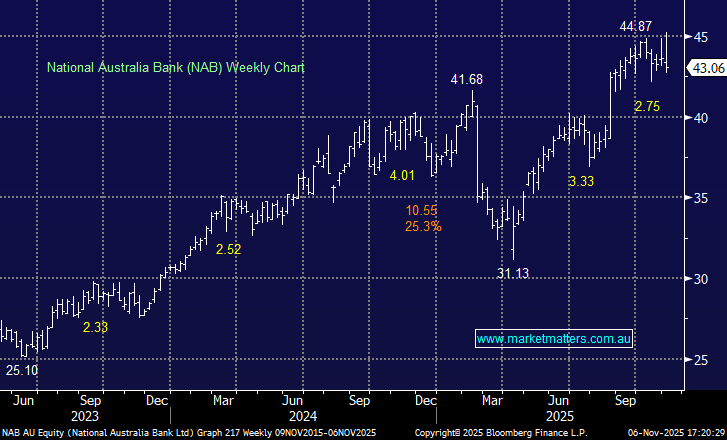

- Longer dated bond yields have drifted lower as the yield curve contracted putting a little pressure on the banking sector e.g. CBA has pulled back 8%.

- The underlying index remains firm even in the face of local COVID adversity and some weakness in the value stocks although global equity markets have remained very supportive.

Overall MM believes the post-GFC bull market remains intact even if its in the mature stages of its evolution hence the way to search for performance since the panic selling in Q1 of 2020 hasn’t changed when it comes to adding value to portfolios:

- Stay core long risk but be prepared to sell into strength as flexibility will be useful allowing investors to be active / aggressive on the buy side during corrections which do occur even in the strongest bull markets.

- Be prepared to switch between stocks and sectors as the macro landscape is evolving especially as bond yields second guess the strength of the post COVID economic recovery.

Overnight US stocks drifted higher led by the tech names – the NASDAQ gained +0.3%, the SPI appears to have found some encouragement from firm European bourses and looks set to open up around 30-points before what’s historically a volatile session to say goodbye to the financial year.