The ASX200 slipped lower on Monday failing to take any cheer from a strong end to last week by overseas markets, the session felt like a drift lower on lack of interest with less than 30% of stocks managing to close in positive territory. With the exception of some solid gains by the iron ore names, following a strong session by the bulk commodity, nothing particularly caught our attention on a day where a disappointing 10 out of 11 of the market sectors closed lower.

Similarly, Asia was in a quiet mood that almost felt like the calm before the storm with no indices managing to move by 1% in either direction. In reality its not surprising that markets have moved into a short-term holding pattern with major earnings numbers coming out this week with the likes of Google, Apple and Facebook likely to have a major impact on US tech stocks while the Feds comments on Wednesday will test the equilibrium of bond yields.

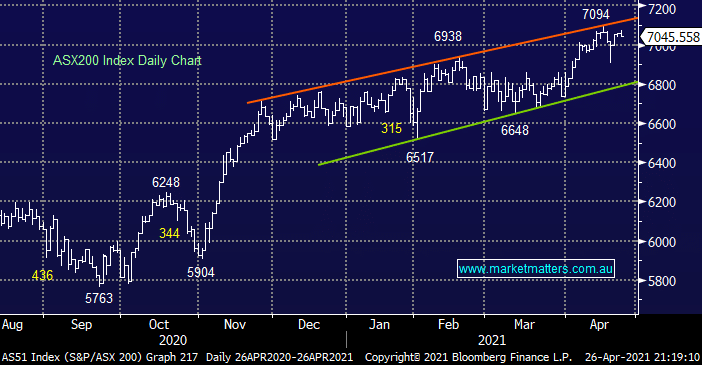

MM has been flagging a potential market pullback from current levels and with April ending on Friday, plus the plethora of macro and market specific news out over the week, were likely to get a good idea if we’re on the money by the weekend.

Overseas stocks closed mixed with the Dow slipping slightly while the tech stocks rallied +0.6% ahead of Tesla (TSLA US) reporting this morning and other major names throughout the week. The SPI futures are calling the ASX to open marginally higher although BHP Group (BHP) rallying 70c in the US should help the local Resources Sector.