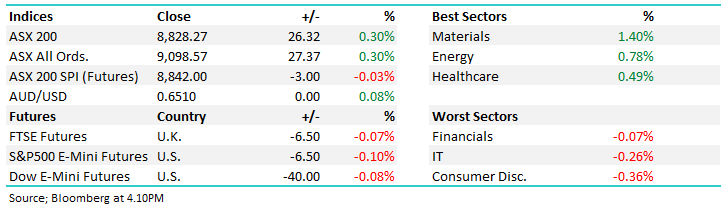

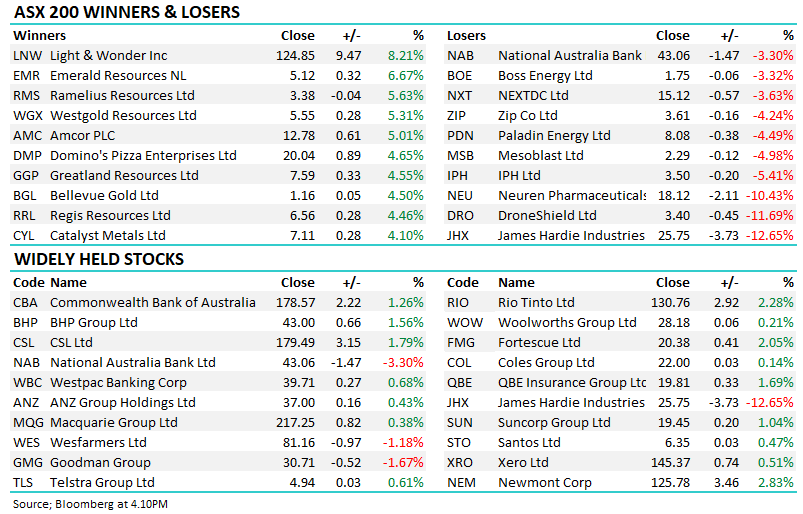

The ASX200 put in an admirable performance on Monday to close basically unchanged even as the country slowly but surely slipped back into a COVID induced lockdown. The broad market struggled with only 35% of stocks closing in positive territory but the selling was noticeably light and strength in heavyweights Commonwealth Bank (CBA), BHP Group (BHP) and CSL Ltd (CSL) was enough to stem the tide. With only 48-hours remaining of this Financial Year I can imagine most fund mangers will be reticent to sell the market after its impressive +23.9% gains so far.

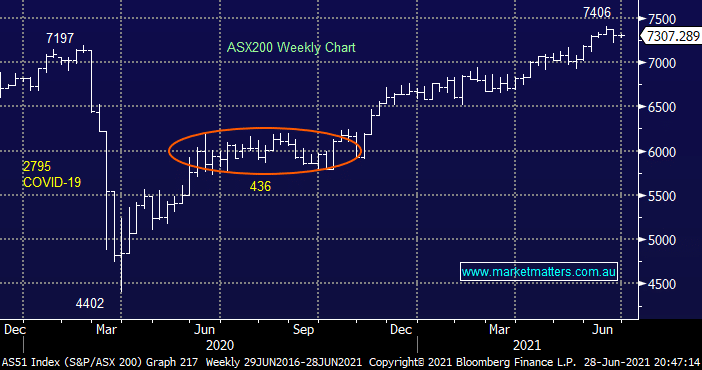

The post GFC bull market remains intact and its clearly going to take more than a few days of Netflix to slow it down, we thought there was a 50-50 chance of a knee jerk fall to the news of the delta strains spread across Sydney and fellow states but we’re an optimistic bunch and investors continue to look through the ‘now” into a vaccine fuelled economic recovery that is underway. Local 3-year bonds saw yields slip slightly yesterday but they remained above last weeks lows implying traders have put back their “best guess” for future RBA rate hikes by no more than a few months i.e. the current lockdowns are not expected to have any lasting and meaningful impact on Australia’s economy.

As we mentioned earlier Wednesdays close will ring the bell on what looks likely to be an excellent financial year for Australian equities i.e. over the last 20-years the markets returned an average return of almost +7.5% pa, a solid number but this financial year looks set to triple this line in the sand. With performance bonuses often squared off at either June 30th or December 31st it’s no surprise fund managers have a reputation for stepping aside at these times of year, especially from selling, which subsequently leads to increased volatility from the stock to index level. As we always say be prepared, especially this time of year, because opportunities may arise on both the sell and buy sides of the coin.

Overnight US stocks were distinctly mixed with the NASDAQ tech names rallying +1.25% while the Dow fell -0.4% with the Energy & Banking Sectors struggling. Europe largely slipped lower with the French CAC catching my eye falling -1%, as is often the case this is the region the SPI follows and its calling the ASX200 to open down around -0.2%.