What Matters Today in Markets: Listen Here each morning

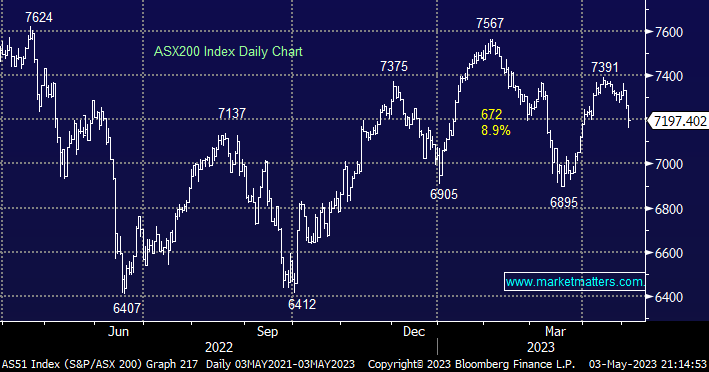

The ASX200 fell another -1% yesterday taking its drop over the last 2 sessions to -1.9% illustrating perfectly how the market wasn’t vaguely expecting the RBA to hike rates on Tuesday – enough said on that already! The selling was broad-based with over 70% of the main board ending the session lower with the Energy and Financial Sectors leading the decline in a similar fashion to the US on Tuesday night.

The lithium and battery metals companies such as Pilbara Minerals (PLS), Allkem (AKE), Mineral Resources (MIN) and IGO Ltd (IGO) took the stage at the Macquarie Conference and overall fund managers liked what they heard with the ESG space catching a bid tone in an otherwise tough day at the office for stocks. One thing we like about our exposure to the likes of PLS and MIN is their low correlation to the ASX although it would be nice if MIN regains some of their mojo enjoyed through 2H of last year.

- Pilbara (PLS) +2.4%, Allkem (AKE) -0.5%, Minerals Resources (MIN) -1.4% and IGO Ltd (IGO) +2%.

On days when the ASX tumbles over 100 points, as it did early yesterday afternoon, it always feels like we’re not holding enough cash in our portfolios although the 11% in our Flagship Growth Portfolio is double that held by the average fund manager in the US. At this stage of the cycle, we are not planning on increasing our market exposure but remaining patient monitoring some quality miners that we will consider at lower levels.

The Fed raised interest rates +0.25% overnight as expected while Jerome Powell reiterated that inflation is still too high but the US economy may still avoid a recession. Bond yields slipped lower as the Fed Chair signalled further hikes may not be forthcoming, and talked to signs of tougher availability of credit given the regional banking crisis which stoked recession fears, the late 270-point fall in the Dow has the SPI Futures pointing to a -0.5% dip early by the ASX200 although BHP traded ~30c higher in the US & has this morning been upgraded to a buy at Goldman’s.

- No change, we are sticking to our “buy weakness and sell strength” mantra for 2023 but after an exceedingly strong 6 months, we remain comfortable increasing cash/flexibility if and when the opportunity arises.