Today’s report as its name suggests usually focuses on the macro-economic factors driving financial markets both today and into the future, however as Sydney goes into a 2-week full lockdown and the rest of Australia feels in danger of following suit the deteriorating local virus picture looks highly likely to dominate both the end of the this financial year, & the start of FY22 – NSW represents ~30% of Australia’s GDP. At MM we will obviously focus on the stock market as opposed the frustrations that have allowed us to go backwards after doing so well since the pandemic first hit the news. Firstly a couple of obvious but important comments:

- One of the reasons Australia has slipped into “COVID 2” is because we’ve vaccinated less than 5% of the population compared to say the UK who have over 60% of people having received both doses plus an impressive 84% the first dose.

- Unfortunately the far more popular Pfizer offering is not likely to be readily available in Australia for 1-2 months posing the question what happens until then, for example will people still be flying into Australia with the Indian variant which we appear incapable of copping with.

- Scarily even with their tremendous vaccination rate, the UK is still suffering almost 15,000 cases per day demonstrating how fast the aggressive delta variant spreads – unfortunately opening up is simply not going to be plain sailing.

Its clearly extremely hard not to agree with Gladys when she says things will get worse before they improve for Sydney, simple mathematics tells us that with the ease with which the delta variant is spreading both here and overseas that there will still be plenty of bumps in the reopening road, especially for unvaccinated countries like ourselves. However this is not a “doom & gloom” report just one that feels we have to be realistic that overseas holidays for example may be on ice until 2023, not the 2022 the Liberals were forecasting in their recent budget. My initial 3 thoughts and I’m sure there will be a few more over the coming days:

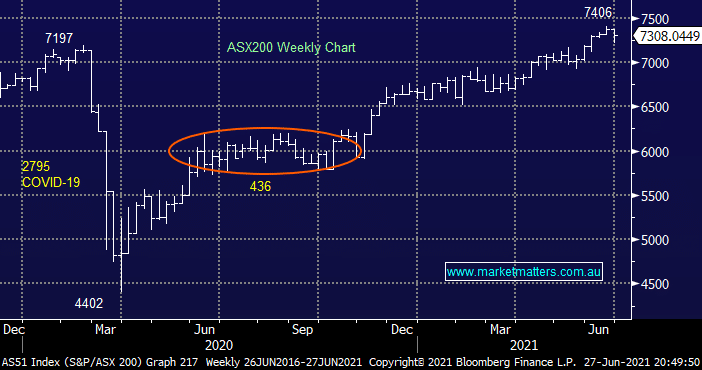

- We’ve been here before, it’s not the end of the world just some stocks, sectors, politicians etc got ahead of themselves.

- History does repeat itself on a regular basis and the local IT stocks should enjoy further outperformance this week.

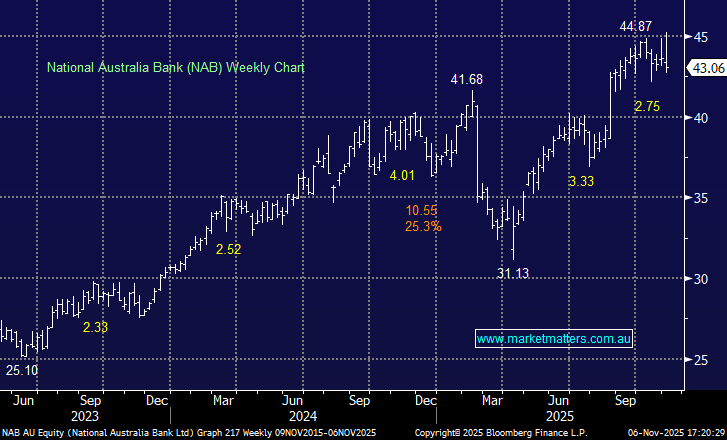

- Bond markets have been calling interest rates up sooner than the RBA, if we fail to deal with this new phase of the pandemic extremely quickly it would appear that Philip Lowe et al are likely to be right for all the wrong reasons.

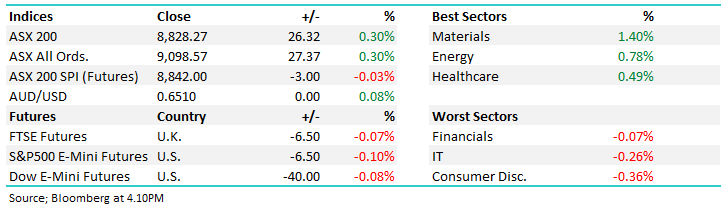

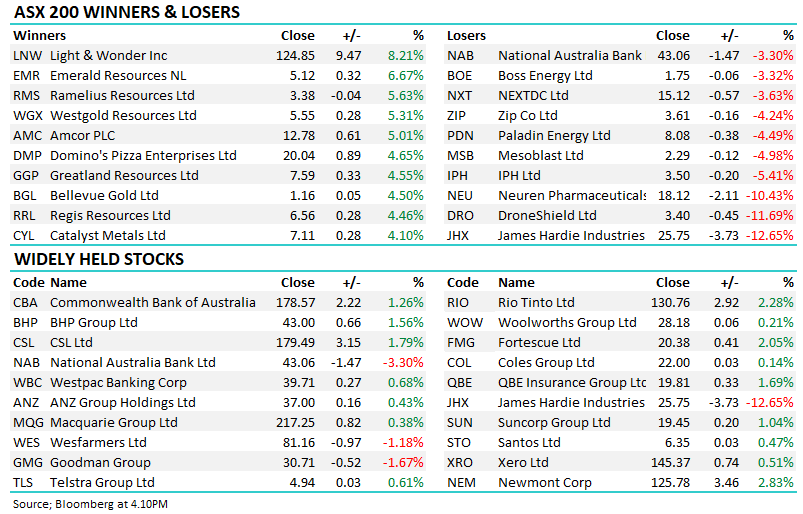

We’re confident in a few months this lockdown will have become merely a talking point although a very expensive one for many especially the entertainment and tourism industries who have been battered over the last 18-months. I hate to sound like a mercenary but at MM we are focusing on the opportunities that may present themselves over the coming week (s) across all 5 of our portfolios – remember this financial year to date our Flagship Growth Portfolio is up ~30% illustrating perfectly how some acute stock / sector rotation can add alpha / value in a post panic environment: View portfolio here