What Matters Today in Markets: Listen Here each morning

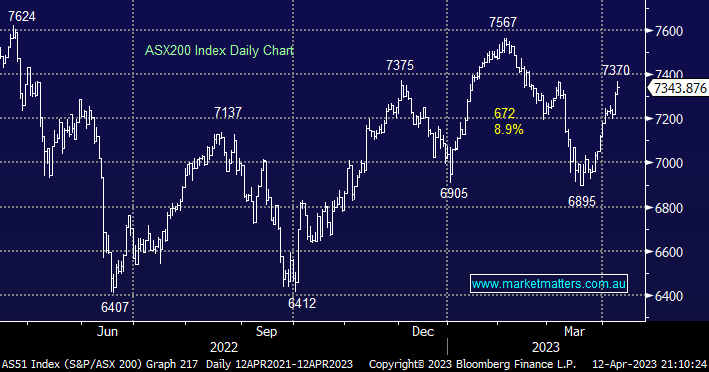

The ASX200 enjoyed another strong day even with the uncertainty of the US CPI looming on the horizon, a quick look at two of the headlines on Bloomberg News yesterday afternoon reminded us that the market is still too bearish and surprises are still likely to be on the upside:

- The US S&P500 is set for a 10% correction, Wells Fargo warns – “In our view, equity downside will be driven by worsening economic conditions, a function of aggressive monetary policy, potential capital/liquidity issues caused by the bank crisis and a consumer that is increasingly reliant upon credit to sustain spending”

- US inflation data will shatter the stock market calm, Goldman Partner warns – “ a hot reading will add more confusion/uncertainty into the equation of what the Fed does from here”.

NB In our opinion the latter of these 2 headlines was taken a bit out of context as the press loves to do but there are plenty of bears around at the moment.

Everyone seems to be warning us of impending doom yet equities aren’t listening, at least not yet. At MM we see things slightly differently:

- Stocks have already absorbed rate hikes, recession fears, and a banking crisis in 2023 yet moving into last night’s US CPI year-to-date the S&P500 was up +7%, the UK FTSE +5.1%, and the ASX200 +4.3%.

- In our opinion the markets are too bearish as the Bank of America Fund Managers Survey illustrated last month with February being the 15th straight month where cash levels sat above 5% – the historical average is 4.7%.

We believe there are several very real hurdles for equities to overcome through 2023/4 but while fund managers are so “cashed up” there will always be buyers into decent dips. Remember our mantra at the start of January “This year MM is a buyer of dips and seller of rallies but with an emphasis on the buy side of the ledger”.

US stocks experienced a choppy session overnight after the market-friendly CPI print initially sent stocks higher only for the release of the minutes of the Federal Reserves March policy meeting showed policymakers agreed that the stress in the banking sector would slow US economic growth. History had told us that the US CPI has been causing major market swings over the last year e.g. over the last 12 months the S&P500 has closed up or down an average of 1.9% on CPI day, more than twice what it has over the previous year. However last night the -0.4% retreat might signal economic surprises and a volatile bond market is behind us.

- Following the +0.4% dip by the S&P500 the SPI Futures are pointing to a small fall this morning not helped by a 20c fall by BHP in the US.