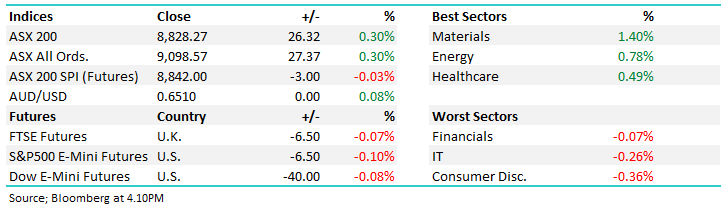

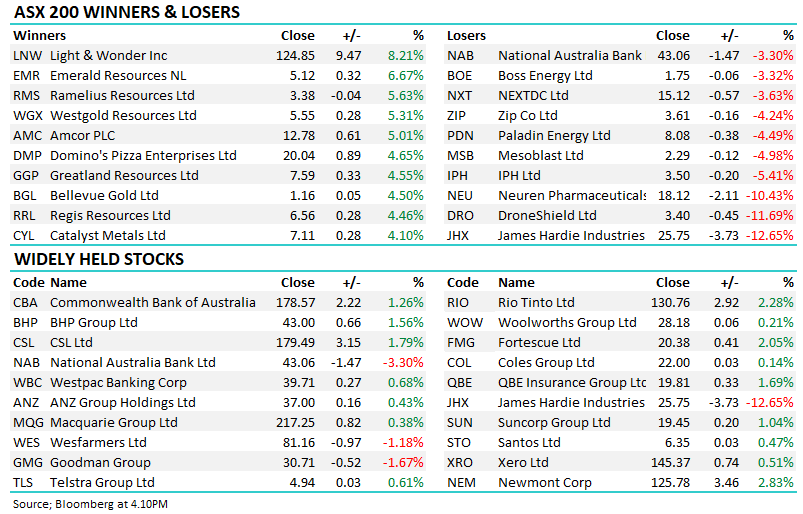

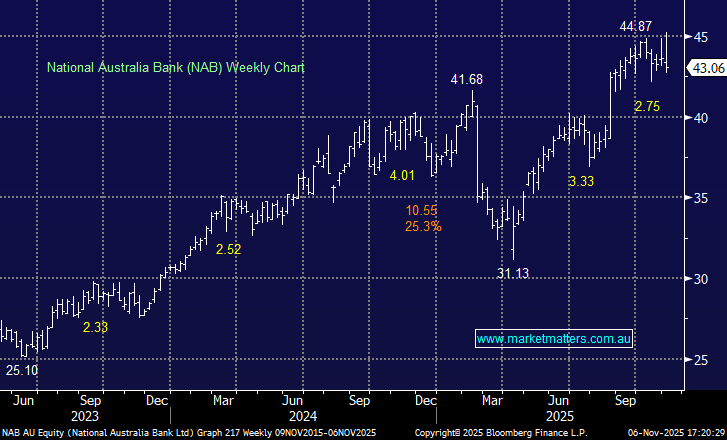

The ASX200 finished a choppy session slightly lower yesterday dragged into the red predominantly by some weakness in the banks and healthcare stocks but considering the escalating Sydney COVID outbreak it was a fairly lacklustre affair. Gladys is fighting hard to avoid a full scale lockdown but as one of my colleagues pointed out today we’re already half way there in terms of day to day life in Australia’s largest city, it’s amazing how few people are going to the city when wearing a mask in the office in mandatory!

The NSW budget was passed down earlier in the week and its already feeling a touch optimistic unless we get lucky with this Indian variant, a few more weeks of hindered trade and Treasurer Perrottet’s assumptions of no more lockdowns will have been blown out of the water, he even is currently working on a timeline of international borders being opened next year! Undoubtedly we have seen more than just green shoots of an economic recovery but any further headwinds will probably see the Liberals stimulate further and definitely not put too many obstacle’s Infront of an already booming property market which this financial year has delivered a thoroughly enjoyed $2.4bn revenue increase from stamp duty.

Aside from COVID the main news for financial markets yesterday was China’s increase in trade hostilities towards our good selves through a WTO (World Trade Organisation) case against us around anti-dumping. This time its literally about the kitchen sink as well as railway wheels and wind towers, I cannot help question the last decades total flouting of patent and counterfeiting laws by the world’s 2nd largest economy but China clearly looks at things through its own strange coloured glasses. However as Treasury Wine (TWE) will testify once China starts flexing its muscles it can be a painful journey and one best avoided if / where possible.

Overnight US stocks powered ahead on economic optimism with the S&P500 again closing at a fresh all-time high, the SPI futures are pointing to a solid +0.7% open this morning following a strong session for the financials in the US.