What Matters Today in Markets: Listen Here each morning

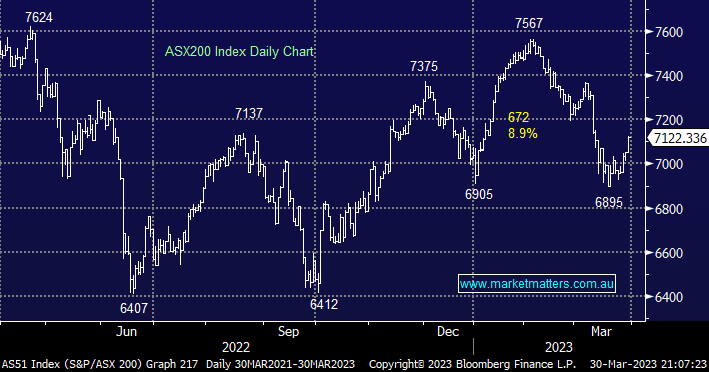

The ASX200 delivered a solid performance on Thursday following a positive lead from overseas bourses and renewed optimism that the RBA has concluded its aggressive rate hiking cycle – we will know the answer to the latter on Tuesday. Gains were broad-based with almost 75% of the main board closing up on the day with only the Real Estate Sector closing lower although it should be noted that 7 of its major companies traded ex-dividend. The banks bounced strongly with the “Big 4” closing up on average +1.56% while a number of our tech positions enjoyed a strong day, very much in the vein of US Indices:

- Xero (XRO) +1.9%, Seek (SEK) +1.8%, Altium (ALU) +1.6%, and REA Group (REA) +1.5% – ideally we are still looking to trim our overweight tech position 6-8% higher.

The lithium stocks remained firm after Tuesday’s panic in Hedge Fund land following Albemarle’s $5.5bn bid for Liontown Resources (LTR), one of the market’s most shorted stocks, but as we alluded to on the day we may have seen their highs for a few weeks though there’s likely to strong support for most lithium names into any pullbacks. Interestingly we read that some brave sophisticated traders might be considering buying Chinese lithium stocks as opposed to our own after this week’s bullish re-rating of domestic names. – more on this later.

Similarly, the other “hot commodity” of late has gone quiet since calm has returned to the Banking Sector but even as the VIX (Fear Gauge) has dropped from over 30 to under 19 the Australian Gold Sector remains steady, a good sign in our opinion. We can see gold consolidating in the $US2000/oz region through April but in our opinion, any dips represent excellent medium-term buying opportunities and surprises remain most likely on the upside.

US stocks rallied overnight sending the S&P500 up +0.5% as traders digested the latest jobs data as their attention moved on from concerns around the Banking Sector following the unnerving failures. The US 10-year yield slipped back towards the 3.5% level as the idea of peak rates gathers momentum. The SPI Futures are pointing to the ASX200 opening up over 0.5% this morning, back above 7150 helped by a +1.7% advance by BHP.

- No change, from a technical risk/reward perspective a close above 7200 is required for us to switch to a bullish view.