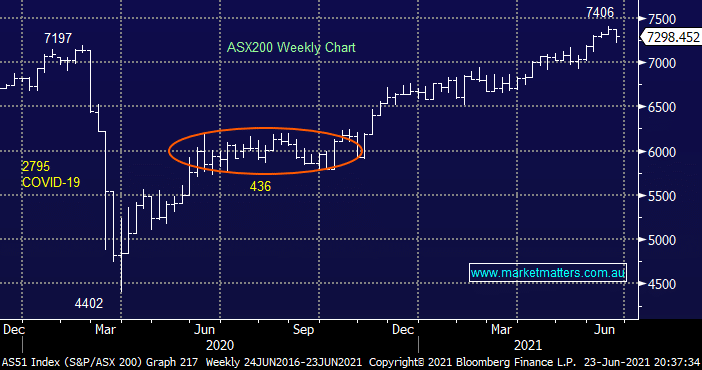

The ASX200 appeared to fall under the weight of the worsening COVID news with NSW restrictions increased as the Bondi cluster continues to grow. I’m not sure what it is about school holidays but lockdowns seem to love coinciding with family travel plans, I have a number of friends / colleagues who had already cancelled their holidays over the last 48-hours but this morning its feels like they would have had no choice anyway! Importantly the weakness on Wednesday felt more like a lack of buying as opposed to aggressive selling with less than 60% of stocks falling i.e. it’s easy to comprehend why investors aren’t keen to chase this market which remains less than 2% below its all-time high as the economic risks escalate as the aggressive Indian strain rolls across Sydney.

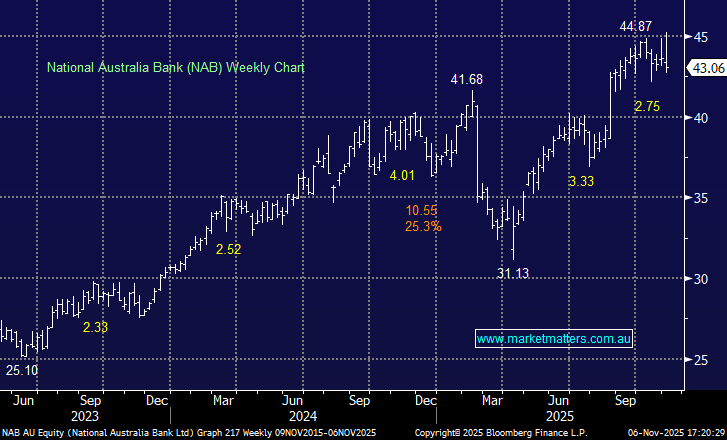

The selling yesterday was focused back towards the banks after Tuesdays reprieve as a number of sector arm wrestles continue, interestingly while the banks fell the other dominant player in the value sector, the resources, actually rallied, our interpretation is as follows:

- The dramatic contraction in the US yield curve following the FOMC last week fundamentally threatens the banks significant outperformance in 2021 i.e. plenty of reasons to at least square up any overweight position.

- The commodities / resources stocks have already corrected fairly aggressively as the $US started basing in May, any session where the greenbacks rally falters seems to offer support to the likes of BHP Group (BHP) and OZ Minerals (OZL).

At this stage MM feels the resources are starting to look for a correction low but as we see further upside in the $US and our target for most major miners remains a few percent lower hence we are maintaining a degree of patience, at least for now. Conversely the travel stocks are remaining all too hard and in our opinion they’re not vaguely cheap enough to consider with the ongoing COVID risks clearly in play e.g. The UK is over 80% vaccinated yet they still had over 14,000 cases overnight.

On Monday we mentioned that influential Westpac economist Bill Evans had brought forward his forecast for when the RBA start raising rates to Q1 of 2023, now the other local market powerhouse Commonwealth Bank (CBA) has thrown their hat in the ring and they’re even more hawkish calling a hike in late 2022 – so much for the RBA’s indications of 2024. Economists are often wrong but whatever the outcome market sentiment is clearly on the move as are mortgage rates, not a great sign for asset prices.

Overnight US stocks were fairly quiet and mixed but the SPI appears to focusing on the deteriorating COVID news both here and in the UK as the Indian strain proves a far tougher adversary. The SPI is calling the market down another -0.4% early on today.