What Matters Today in Markets: Listen Here each morning

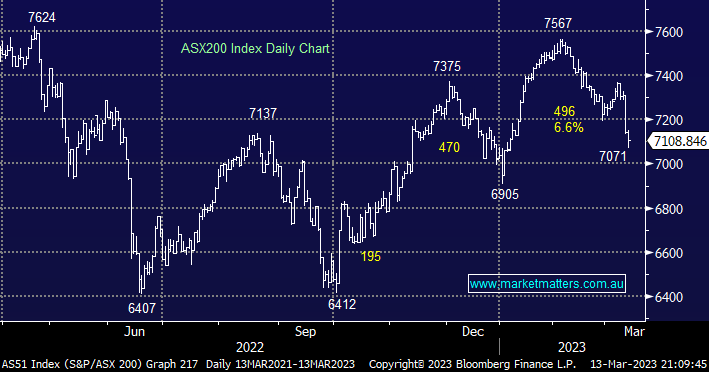

The ASX200 fell another -0.5% yesterday as concerns washed through financial markets of a deep and painful fallout from the demise of Silicon Valley Bank (SIVB US), amazingly after being valued at $US45bn in November 2021 overnight we saw HSBC buy SVB’s UK arm for just $1 – sounds like something from the movie Trading Places. In the US regulators stepped up to bail out customers of SVB which included hundreds of tech start-ups promising all depositors would be repaid in full plus they established a new line of funding to protect US regional banks.

- The news initially sent US S&P500 futures up almost 2% but as European indices commenced trading all of these gains had been surrendered i.e. volatility isn’t going to vanish overnight.

- MM believes the “Fed Put” is being dusted off by the US central banks which adds to our confidence to slowly start accumulating stocks into weakness.

MM remains committed to our “sell strength & buy weakness” approach to 2023 with a slight positive bias, different from last year when we were happier sellers than buyers. Yesterday’s selling was again broad-based with over 75% of the main board falling and as we flagged in Monday’s Macro Report the performance under the hood was a perfect reversion to last week with only the Energy & Materials Sectors closing positive, last week’s big losers.

One market-friendly result of the SVB collapse has been delivered by the bond market which has seen traders reduce their hawkish bets. On Monday the Australian 3-year yield closed at 3.2%, well below last week’s 3.6% high. In the US we saw Goldman Sachs desert its call for a rate hike in March as analysts ponder if the Fed dare push rates ever higher amid banking concerns caused by the same rising interest rates albeit it in one ill-advised bank which complacently didn’t consider hedging an enormous risk exposure.

- On the index level we see initial strong support around the 7000 level but at MM we are more about stocks/sectors through 2023.

US stocks tech stock rallied overnight as the US 2-year yield experienced its largest 3 days plunge since Black Monday in October 1987. Safe haven assets were in demand with gold surging over +2.7% and US 10-year Treasuries hitting a 6-week high (yields lower) investors are now pricing in less than a 50% chance of any rate hike by the Fed this month, only a week ago many were looking for a 0.5% following another hawkish presentation by Jerome Powell.

- Following weakness by the Banking Sector in Europe and the US the SPI Futures are calling for the ASX200 to fall -1.9% early this morning, back under 7000.