What Matters Today in Markets: Listen Here each morning

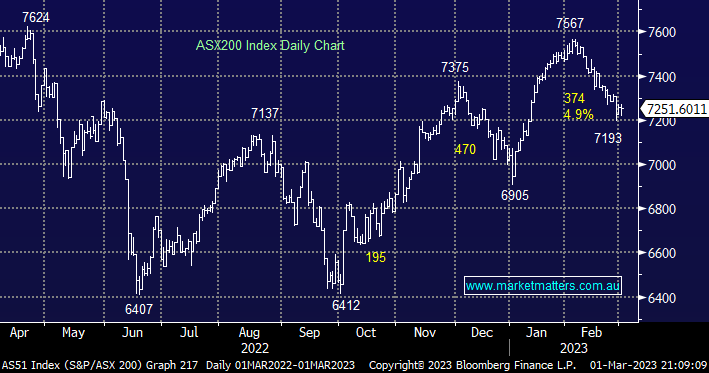

The ASX200 closed marginally lower yesterday following another case for equities that “bad news is good” as we saw a strong rally from late morning lows following weak economic data , it wasn’t enough to repair all of the early damage but a -0.1% fall isn’t going to worry too many investors. Yesterday we saw 3 main pieces of economic data drop which were all taken favourably by the ASX:

- Australian inflation (CPI) for January came in well below expectations at 7.4% – consensus was 8%.

- Local GDP Growth for the 4th quarter was weaker than expected coming in at +0.5% – consensus was +0.7%.

- China’s Caixin PMI came in above expectations at +51.6% – consensus was marginal expansion at +50.2%.

The net result across financial markets was largely as expected although not all stocks/sectors moved as would be expected:

- Australian bonds rallied (yields lower) on the combined weak inflation and growth data – 3 year bond yields traded back to 3.5% after testing 3.7% last week.

- The Australian Dollar traded down to its lowest level since the start of 2023 on the prospect that rates wont go as high as recently feared.

- Equities bounced and in particular the resources stocks which focused on the strong data from China.

We continue to believe local stocks are “looking for a low” but we would have expected the Tech Sector to enjoy a bid tone yesterday as bond yields drifted lower yet it closed down -0.6% – in hindsight it picked the -0.9% fall by the US tech based NASDAQ perfectly!

US stocks closed mixed overnight with the Dow edging higher while the S&P500 fell -0.5% as US bond yields ground ever higher, the 10’s tested 4% dragging the growth stocks lower although the $US surprisingly slipped -0.4%. The weakness in the Greenback helped the commodities which look set to support the Resources Sector with BHP rallying +50c in the US helping the SPI Futures to close largely unchanged this morning.

February saw short-dated bond yields test multi-month/year highs but their longer dated peers have been fairly subdued remaining well below levels reached in 2022. We have a bearish bias towards these longer dated yields due to our view that the domestic economy is weaker than the RBA believe – yesterdays data implies we may be proved correct sooner rather than later.

- We continue to believe the local 10-years will trade between 3% and 4% over the coming months i.e. a positive read through for growth & tech stocks.

Today we’ve briefly taken another look at the banks as they continue to weigh on the market – only ANZ out of the “Big 4” is up year-to-date. We are underweight the sector which is intentional given our views around the weakness creeping into the Australian Economy and our belief that interest rates (bond yields) are ‘looking for a top’. However, given this underweight stance and broader interest within the sector, our question today is where we would consider increasing our exposure?