What Matters Today in Markets: Listen Here each morning

January saw investors become overly optimistic that central bank pivots were close at hand and rate cuts would add some cheer for mortgage holders into Christmas, the net result was the ASX200 roared +9.6% in less than 6 weeks i.e. more than the market average annual gain over the last 20-years. However, as we all know following some surprisingly strong economic data the RBA & Fed have stamped aggressively on any dovish outlook and suddenly markets are looking for official interest rates to peak at 4.4% in Australia and 5.4% in the US.

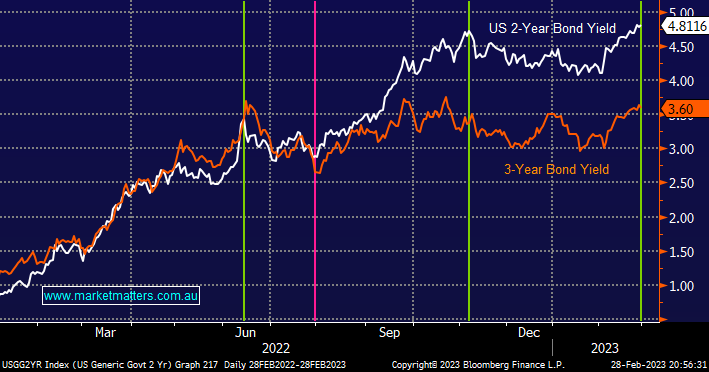

- MM believes markets and central banks have become too hawkish and yields are already close/at a peak for 1H of 2023.

Our reasoning obviously is different across the 2 continents but locally its primarily about the “mortgage cliff” which is approaching for thousands of Australians later in 2023 e.g. it might surprise many to know that the interest rate on small business Federal Government support packages offered during COVID has already ballooned above 10.5% after commencing under 4.5%, interest rates weren’t fixed on these loans and the banks are having a proverbial field day!

- MM believes the Australian consumer will at the absolute best be cautious through 2023 as fixed mortgages spike from 2% to well over 6%.

One of the strong reoccurring chart patterns over the last year has been markets failing to break out on both the downside & upside, many markets remain range bound albeit in volatile holding patterns. Assuming we are correct with this outlook yields are close to reversing lower which should benefit risk assets and in particular growth sectors such as tech, however, the resources might not join the party if we see the moves unfold due to increasing recession fears.

Tuesday again saw ASX investors focus on reporting season with retail stocks coming under significant pressure, as we mentioned earlier the local consumer is about to have significantly less discretionary spending e.g. Super Retail Group (SUL) -2.2%, JH Hi-Fi (JBH) -2.7% and Harvey Norman (HVN) -7.5%. One characteristic we did notice yesterday was some bargain hunting surfacing into stocks which started on the back foot e.g. HVN reclaimed 45% of its initial losses while Sandfire Resources (SFR) reversed an early -6.7% dip to close up on the day. One day doesn’t make a summer but this is usually what starts to unfold when markets “are looking” for a low.

The US experienced a mixed session overnight with the Dow slipping 0.7% while the tech-based NASDAQ only edged down -0.1% i.e. exactly the sort of relative performance we expect to unfold through March. The SPI Futures are calling the local market down -0.3% early this morning which feels about right with BHP up +10c in the US.

- We believe the ASX is looking for a low with tech likely to lead any recovery through March.