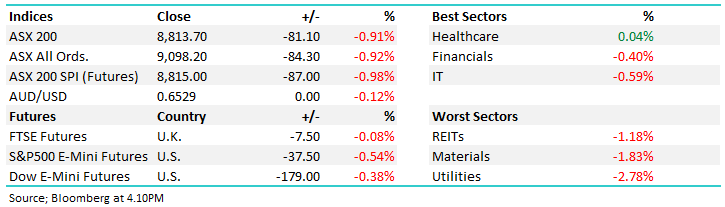

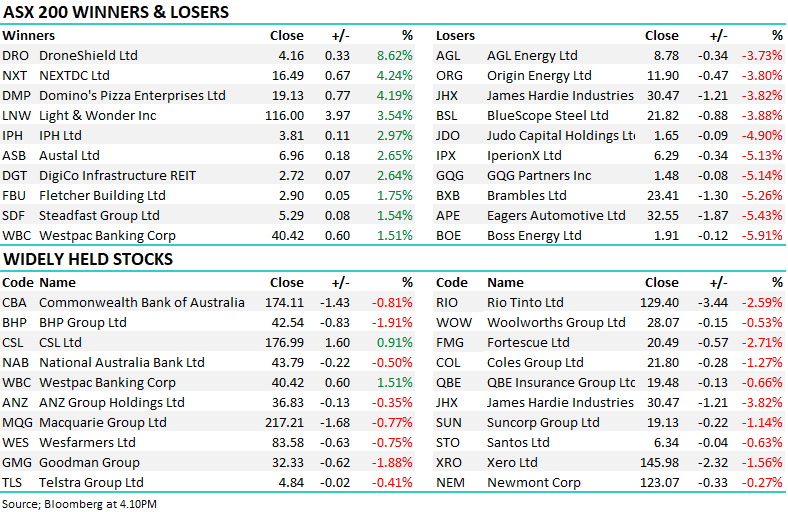

The ASX200 delivered another fascinating session on Thursday with 8% of the main board moving by over 5%, with the winners dominating 15-1 it wasn’t surprising to see the index close up +0.8%, even with Commonwealth Bank (CBA) falling another -1.5%. Under the hood, the IT and Consumer Discretionary Sectors were the standouts both rallying +2.7% – interesting to see the interest rate-sensitive stocks outperform in a week when short-term bond yields are making 4-month highs.

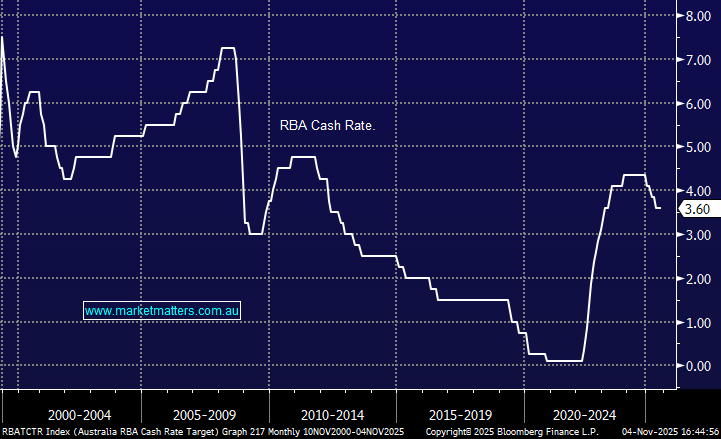

The Australian employment data surprised many yesterday as it weakened for the 2nd consecutive month with unemployment jumping to 3.7% from 3.5% – economists had been expecting the rate to remain flat at 3.5%. Equities increased their rally on the numbers with the loss of more than 40,000 full-time jobs putting into doubt the path of the RBA Cash Rate through 2023 – MM has expected the jobs market to soften, signs of which might keep the cash rate from pushing through 4%.

Reporting season delivered for the bulls yesterday with company earnings simply not as bad as many feared which is helping defy the numerous bears in the media. Macroeconomics apart it’s hard to be bearish with the French CAC 40 and UK FTSE making fresh all-time highs, even when war continues to rage in Ukraine – remember the ASX is far more correlated to European than US equities. When we look at our Flagship Growth Portfolio its composition feels good but our 18% cash holding feels on the rich side if we are going to see the bears capitulate as they have in Europe:

- We remain overweight tech stocks which feels correct with the local sector on course to rally another 10-12%.

- We remain underweight the banks which feels correct as discussed yesterday.

- We have trimmed our resources back to a market weight that feels correct as the $US bounces although much of the sector has proved resilient.

- We are still underweight on the defensives, industrials, real estate, and consumer cyclical some pockets of which are performing well through reporting season.

Although we are neutral on the index around the 7400 area with tech, European, and US indices looking strong it’s hard not to get a feeling of missing out during strong days such as Thursday.

US indices pared early losses overnight after producer prices rose faster than last month and one Fed policymaker scarred some by saying she saw a “compelling reason for 0.5% by the Fed next month”. The Dow tried to recover its original 400 points dip following the news before succumbing with the S&P500 closing down -1.4%, the SPI Futures are pointing to a 0.25% dip early this morning helped by a 70c move higher from BHP in the US.

Yesterday saw one of our tech holdings Altium (ALU) hit our $41 target area but considering our overall view towards the sector we have maintained a degree of patience towards trimming/cutting this position i.e. it’s currently showing us a +46% paper profit.