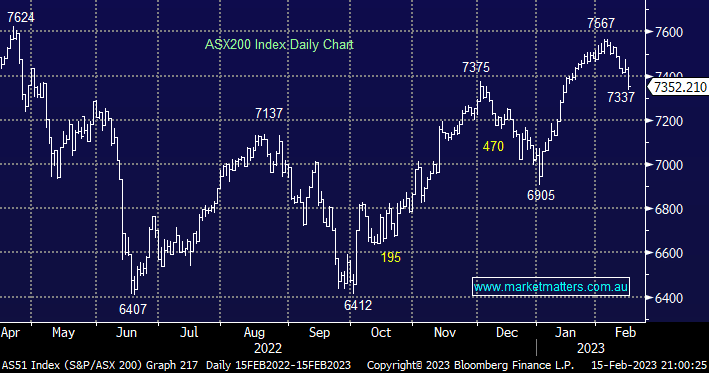

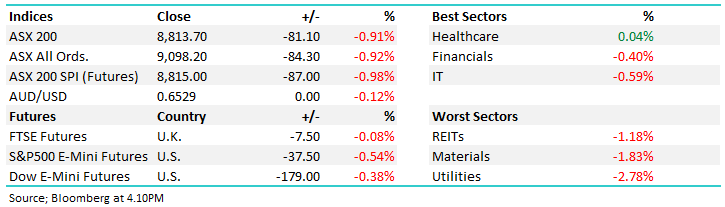

The ASX200 tumbled over -1% yesterday after Commonwealth Bank (CBA) dragged both the sector and index lower, by the close the “Big 4” banks were responsible for over two-thirds of the main index’s 78-point fall. During the day we saw noticeably large volume through the futures market as nervous investors appeared to move to the sidelines following the market’s +9.6% rally from its early January low – in just 8 trading days the local market has surrendered over 200 points or 3%.

- The market’s reaction to the CBA result made it feel like a “straw that broke the camel’s back” event as the downside momentum gathers pace following the one-way upside traffic since the start of 2023.

- From a risk/reward perspective it’s now hard to get excited by the main board unless it can close back above 7410 although in today’s fickle market that is less than 1% away.

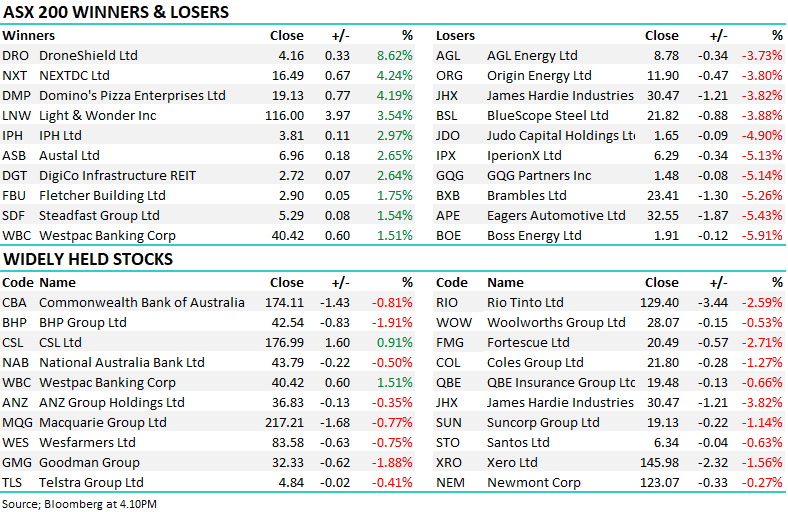

Yesterday interestingly saw 99 winners & 99 losers in the ASX200 which when the market falls over -1% illustrates perfectly that stock/sector rotation is the main game in town, the characteristic is being amplified further by the current reporting season. The ASX made another 4-week low yesterday as poor news on the stock front continues to be dealt with harshly plus the RBA is threatening to push rates even higher than many feared.

- Company misses are not being tolerated by investors, both current earnings and forward-looking guidance i.e. it’s ruthless out there!

- However encouragingly strong numbers are still seeing stocks advance strongly with 5-10% gains commonplace over the last week.

US indices experienced another mixed session overnight with the tech-based NASDAQ rallying 0.8% while the Dow edged up just +0.1%. The SPI Futures are pointing to an open back around 7390, up ~0.5% helped by BHP trading 40c higher in the US. The most eye-catching move on Wednesday night was the $A, it tumbled -1.2% back to the 69c area which might see some overseas buyers resurface.

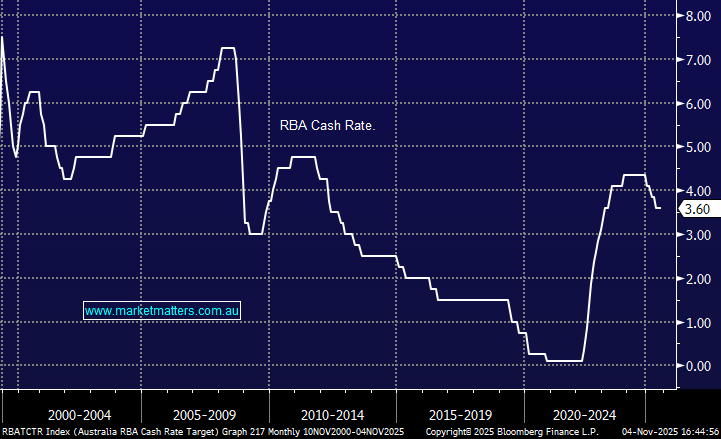

Dr. Philip Lowe was “grilled” at the Senate committee yesterday but stuck to his hawkish guns which suggest a very tough year ahead for mortgage holders:

- He declared inflation was still “way too high” suggesting the most rapid tightening cycle in our lifetimes has further to go.

- The jury is out on how much further rates will rise but his comments were ominous “How far we have to go up – I don’t know. It’s going to depend upon the inflation data, the resilience of spending, the strength of the global economy and what’s happening with growth and wages”.

We still see the RBA taking rates up to ~4%, from today’s 3.35% level, but the futures market is now gunning for 4.2% by September – he’s already warned that he’s comfortable being unpopular suggesting that any surprises are likely on the upside.

- We believe the more than 800,000 fixed loans switching to variable this year will slow things faster than many anticipate hence our 4% target.

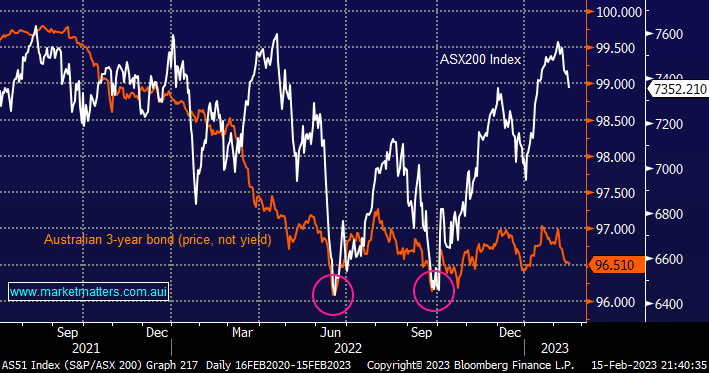

The strong correlation between the ASX200 and Australian 3-year bonds is of concern to us, especially from a risk/reward perspective, the last few times bonds tested current levels stocks were around 10% lower, one of the reasons MM is comfortable with our de-risking approach through January.