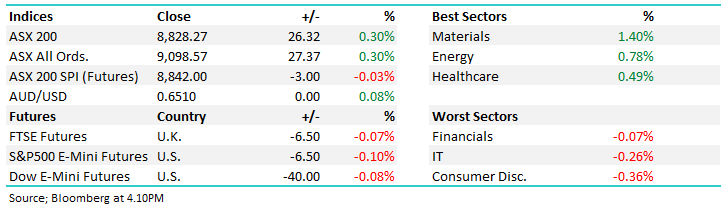

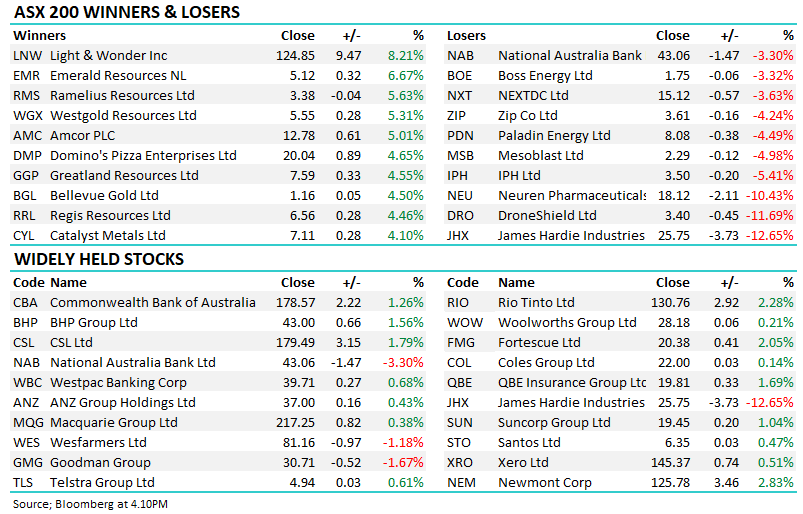

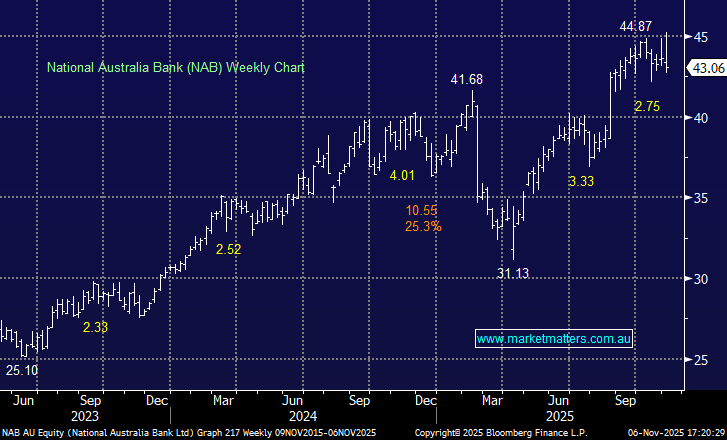

The ASX200 followed Fridays weak lead from global indices finally closing down -1.8% with the heavyweight Banking Sector surrendering some of their recent impressive gains, it felt like a session of aggressive profit taking with the stronger performers over the last 3-months suffering the most e.g. Commonwealth Bank (CBA) fell -5.4% after rallying over +15% over the last 3-months. Elsewhere only the perceived safety of IT and supermarket stocks caught my eye on the upside on a day where winners were very hard to find.

Over recent weeks MM has forcefully pushed the sector rotation from value to growth which has largely played out according to plan, aided by short dated bond yields rising while their longer dated cousins fell to multi-month lows. However it’s important not to become married to ideas in today’s rapidly evolving market in which stocks / sectors are going in and out of vogue as much as the Sydney weather. A few things catching our attention as this cycle unfolds:

- The underperformance baton within the value sector appears to have handed from the resources to the banking stocks which admittedly have defied gravity for months.

- The resources stocks are slowly finding support into current market weakness and a few of the larger names are within 2-3% of our targeted buy zones.

- Conversely the banks appear to have further potential on the downside with around 6-8% sector weakness our ideal scenario.

- The IT stocks have run hard over the last month, we believe they go higher but their outperformance might start to tire sooner rather than later.

Overnight US stocks surged as the $US drifted and longer dated bond yields bounced, the S&P500 ultimately closed up +1.4% led by a recovery in the value stocks as sectors continue to run their own race on most timeframes. The SPI Futures are calling the ASX200 to bounce almost 100-points this morning, regaining ~70% of yesterday’s losses in the process.

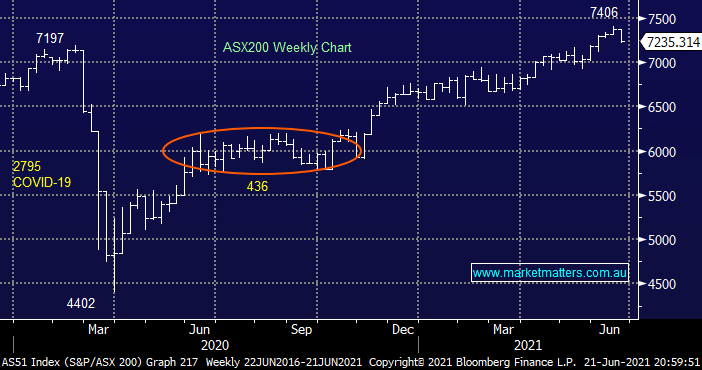

We like to be optimists at MM and yesterday was the years shortest day meaning summers just around the corner! More seriously the overnight recovery in US stocks reiterates our stance that while aggressive rallies can be sold our preference remains to buy the dips as the post GFC Bull Market remains intact, if a little extended.