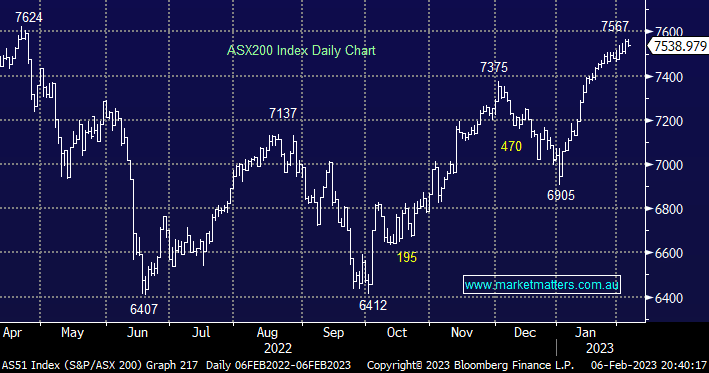

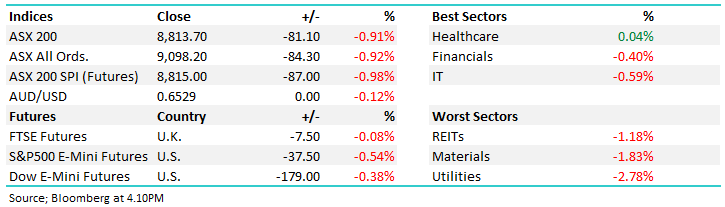

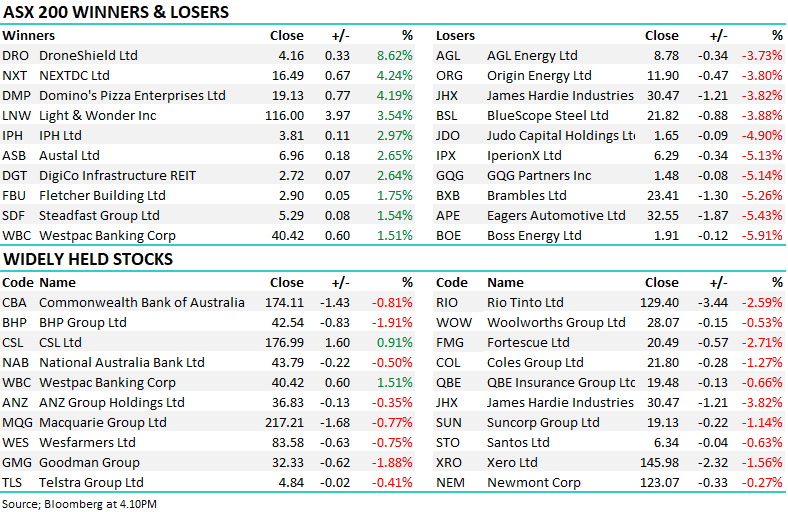

The ASX200 ended Monday down -0.25% following Friday’s weak session on Wall Street coupled with follow-through selling in the pre-market S&P500 futures. The weakness was broad-based with less than 30% of the main index closing in positive territory with the winner’s circle being dominated by the energy and gold names – more on the precious metal later following Newmont’s (NEM US) bid for Newcrest (NCM).

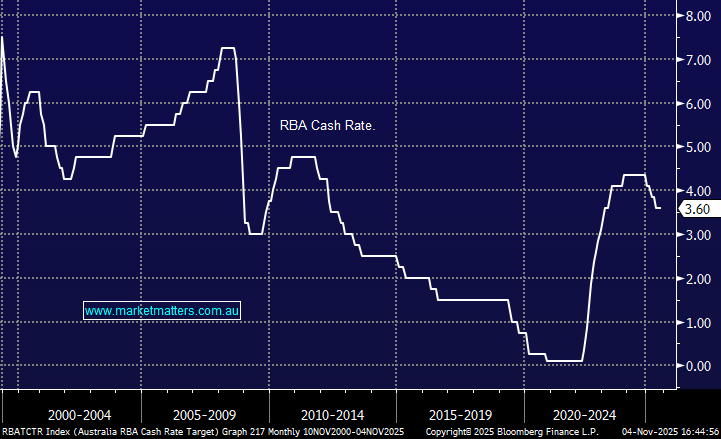

The local bond market followed its US peers lower after the surprisingly strong US Jobs Report on Friday, the local 3-year yield from 3% to 3.1%, not a significant move in our opinion considering the RBA is set to hike rates this morning with many calling for a “super-size” move:

- The RBA is set to hike rates by 0.25% from 3.1% to 3.35% at 2.30pm but the markets are apportioning a 25% possibility the push them all the way to 3.5%.

- At MM we believe they will probably go 0.25% but what’s more important is where they end up in 2023 and we still have ~4% as that target.

Our main concern around whether ASX can add to its stellar gains over the last 5 weeks is not surprisingly the RBA and fellow central banks:

1. We believe the Fed will take rates towards 5% and the RBA 4% but we cannot see them being cut this side of Christmas unless the global economy goes into a deep recession, neither of which is good news for equities.

2. Also we don’t believe the market is building in any meaningful degree of risk that these moves might not be enough to reign in inflation e.g. nobody is talking say 6% and 5% respectively.

US indices experienced a relatively quiet session overnight with the Dow closing down just -35 points, the SPI futures are pointing to a flat open locally by the ASX200 not helped by a 20c drop by BHP in the US.