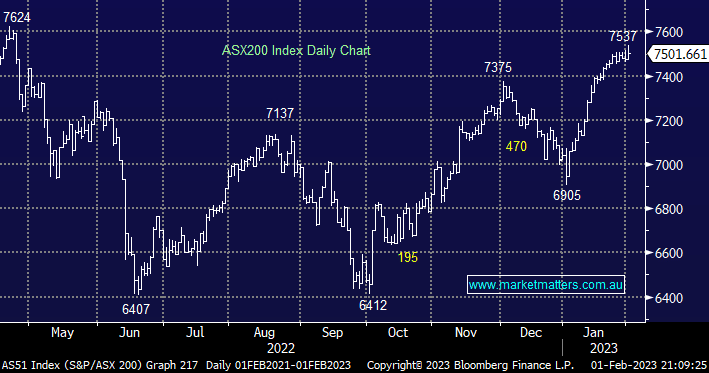

The ASX200 rallied +0.3% yesterday finally closing above 7500 although the index still surrendered well over half its early morning gains as the US futures drifted lower during their late session. Overall it was a fairly mixed session with over 40% of the main board closing in the red, the Energy sector weighed on the index slipping -1.2% while Real Estate was the standout rallying +1.4%. The market was understandably nervous ahead of this morning’s Fed policy decision – another +0.25% hike was anticipated taking rates between 4.5% and 4.75% as expected.

At 6 am this morning the Fed indeed hiked rates 0.25% but it was the press conference from Chair Jerome Powell that added the real spice to the mix:

- The Fed hiked interest rates as expected while remaining hawkish by indicating further hikes lay ahead to combat inflation.

- “The committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time.” – Jerome Powell.

In our opinion markets took the news in a mixed and uncertain fashion:

- with US 2-year yields initially rallied before falling to 4.09% on increased recession fears led to the Fed Swaps pricing in 0.5% rate cuts from a June peak.

- the $US fell back towards 101 reversing earlier losses in gold and stemming losses from the likes of copper.

- US stocks experienced a rollercoaster ride with the Dow trading in almost 800-point range before closing up just 6 points!

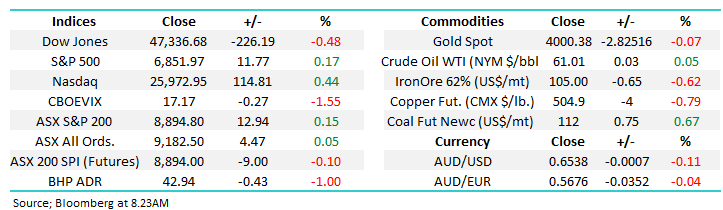

US indices were overall mixed overnight following the Feds hike and rhetoric, the Dow was unchanged while the tech-heavy NASDAQ rallied +2.2% – a trend we’ve been riding of late. The SPI Futures are calling the ASX200 to open up 0.3% but a 40c fall in BHP suggests it’s going to be a very mixed bag under the hood at the start of today’s session.

This morning we’ve briefly looked at 3 Real Estate stocks that caught our attention yesterday as the sector continues to perform very strongly in 2023 i.e. it already rallied +9.6% compared to say the Energy Sector which has struggled to remain positive closing up just +0.11% year to date.