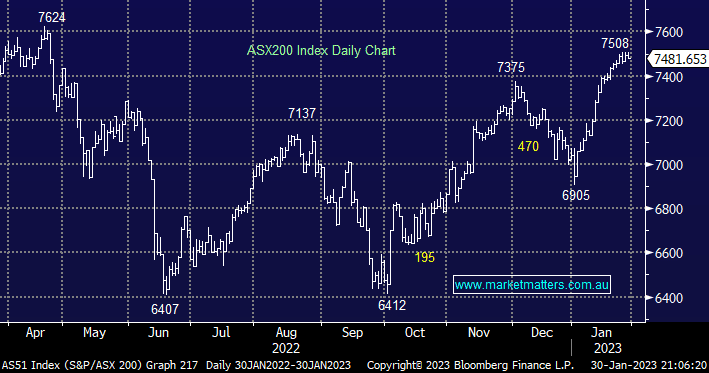

The ASX200 slipped -0.16% yesterday in the process demonstrating a couple of points we’ve been highlighting of late:

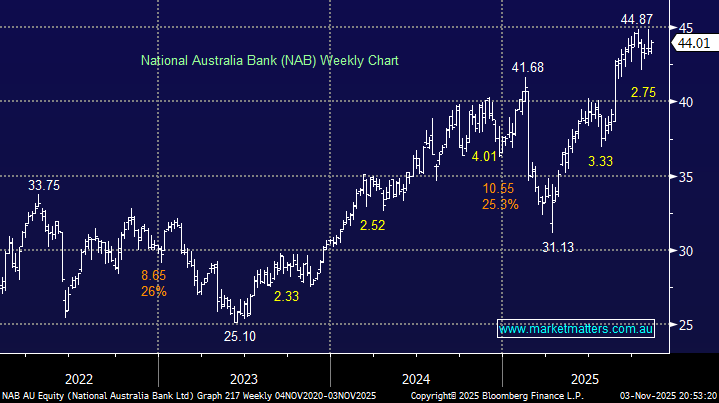

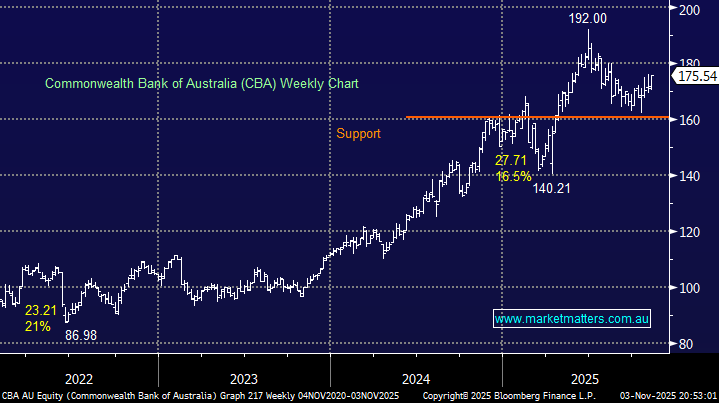

- The local market feels tired around the 7500 level as the heavyweight leaders experience some profit taking e.g. Commonwealth Bank (CBA) -0.1%, BHP Group (BHP) -0.6% and CSL Ltd (CSL) -0.6%.

- The Tech Sector is starting to enjoy some performance catch-up with some mild profit-taking across many of the resource names catching our attention.

We continue to hear pessimism from most corners of the market which was again the predominant view in the latest MLIV Pulse Survey, it produced a level of negativity that even surprised us and we’ve been calling out this crowded bearish positioning for months:

- 70% of people surveyed still believe the market will break last year’s lows later this year, the favourite timeframe being 2H of 2023.

- Concerns remain elevated around company profits as the global economy looks set to slow, most investors now believe the results from the likes of Apple Inc (AAPL US) and Exxon Mobil (XOM US) are more pivotal to the S&P500 than the coming moves by the Fed.

The trouble for the bears is that markets rarely fall when they’re surrounded by negativity even if the macroeconomic picture looks clouded at best. The most aggressive rate hiking cycle in decades combined with wage and cost increases is undoubtedly a challenging environment for companies to grow profits hence at MM we remain happy to sell strength but not weakness when so many investors remain bearishly positioned.

NB: The Bloomberg Markets Live team does a weekly investor survey, asking questions about different elements of financial markets i.e. It’s called the MLIV Pulse Survey, so named because it’s the Markets Live team taking the pulse of financial markets.

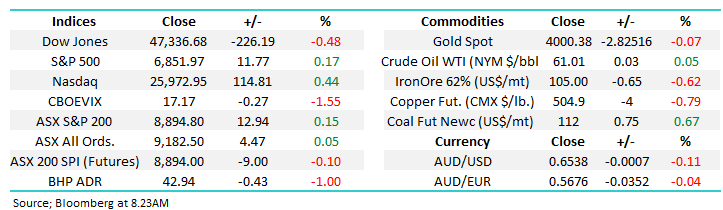

US indices fell overnight as markets adopted a cautious stance ahead of the Feds rate decision and earnings reports from the likes of Meta Platforms (META US) and Alphabet (GOOGL US), the S&P500 finally closed down -1.2% with weakness in tech weighing on sentiment ahead of major releases. The SPI Futures are only calling the ASX200 down -0.1% helped by BHP recovering ~20c in the US.