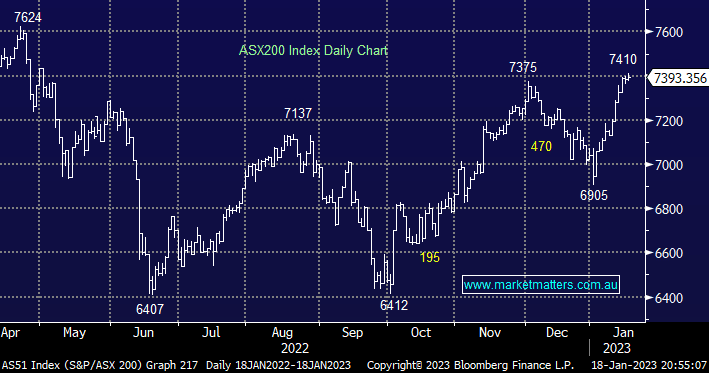

The ASX200 edged up +0.1% yesterday helped by further gains by the Tech Sector while losses in Real Estate & Utilities dragged on the index although it was overall a quiet day illustrated by only two stocks on the main board moving by more than 5%. The Bank of Japan (BOJ) produced the most fireworks during the lacklustre session when they surprised many pundits ignoring market speculation/expectations for policy tweaks sending the Yen tumbling in the process. There were some major moves at 2 pm on the announcement albeit fleeting in some cases:

- The Yen was smacked as the BOJ stuck to its ultra-easy money policy, a move we will look to fade in our Macro ETF Portfolio if it can last.

- The Nikkei roared up 652-points, or 2.5%, closing near its highs on the day.

- The SPI Futures popped up almost 40 points on the news but the excitement only lasted ~10 minutes before the slumber returned.

Elsewhere on the global macro front, China has been attempting to convince the world from the world economic forum in Davos that they’re open for business and will return to normal growth this year even though their GDP is currently growing at its slowest pace since the mid-1970s, bar the outbreak of COVID, plus their population is now shrinking for the 1st time in 60-years. Chinese equities paid no attention on Wednesday with the CSI 300 Shenzhen Index edging down -0.17% on the day.

- MM believes China will aggressively stimulate their economy at some stage in 2023 which should provide a great tailwind for the Resources Sector.

US markets fell away overnight after a promising start as recession fears increased following a drop in retail sales and slowing inflation, US bond yields also fell across the curve after the numbers e.g. US 10-years closed down -0.17% at 3.37%. The S&P500 closed down 1.6% and the SPI futures are pointing to a 0.4% dip by the ASX200 early in the day, not too bad under the circumstances.