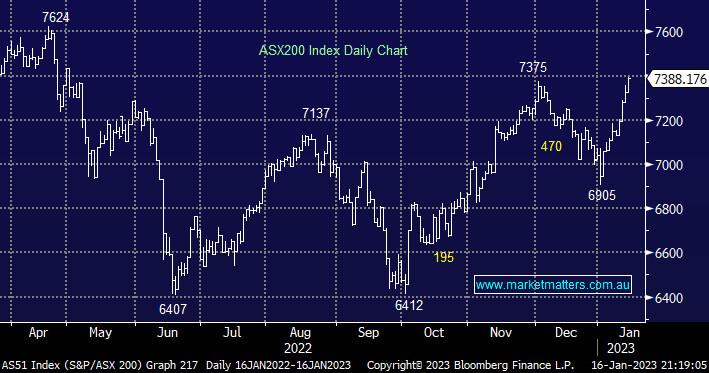

The ASX200 rallied another +0.8% yesterday on broad-based buying reaching levels not enjoyed since June of last year, over 75% of the index advanced, and all 11 sectors advanced while in the loser’s corner lithium and iron ore names were the market’s weakest pockets. As we head into what most pundits believe is an almost certain recession the local market is now only 3.2% below its pinnacle posted last August – investors might be bearish but the stock market is not listening.

The pressure valve feels like it’s been released on the growth stocks after months of intense pressure from rising inflation and bond yields, this morning we have focused our report on whether MM believes they have further to rally or it’s time to start fading the move. The Australian 10-year bonds have already fallen around 0.75% as inflation cools helped by cheaper fuel costs. The Feds job may be getting easier following last week’s -0.1% drop in the December CPI, however, while the inflation picture is improving it remains well above the Fed’s target of 2-2.5% hence more rate hikes are likely in Q1.

- The Federal Reserve raised the fed funds rate by 50bps to 4.25%-4.5% following its last monetary policy meeting in 2022, in the process pushing borrowing costs to the highest level since the GFC, over 15 years ago.

- We can see further hikes short-term as the Fed remains committed to its hawkish stance but the mellowing expectations have seen bond yields and the $US correct helping stocks enjoy a rally almost across the board.

We continue to question how much upside the overall market can enjoy with interest rates substantially higher than in mid/late 2021 e.g. Australian 10-years have surged from ~1% to over 3.5% but on a stock-by-stock and sector-by-sector basis the answers are likely to very different. There are no sell signals in today’s evolving market but we do believe it’s prudent to migrate slightly back down the risk curve into current strength – watch for alerts over the coming weeks.

US markets were closed overnight for Martin Luther King Day while the S&P500 futures drifted -0.2% and the SPI futures are pointing to a similar dip when the local market opens this morning.