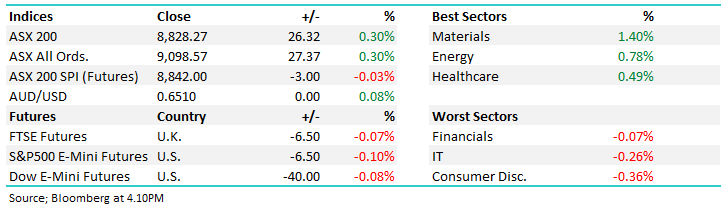

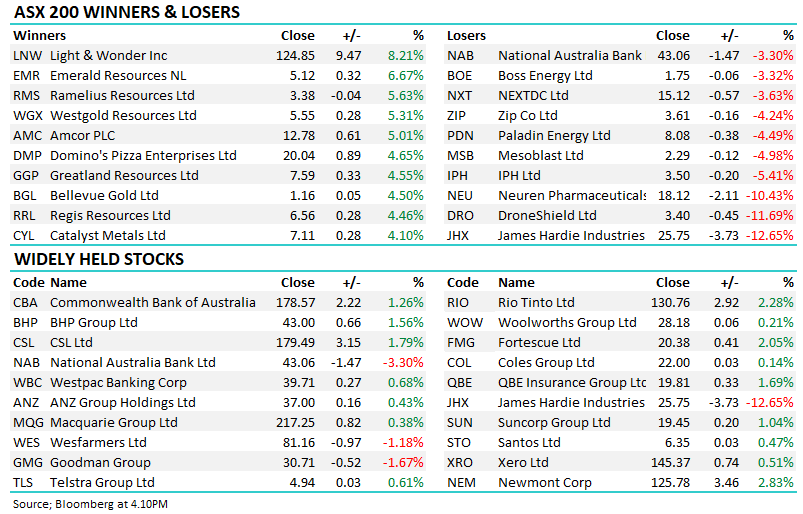

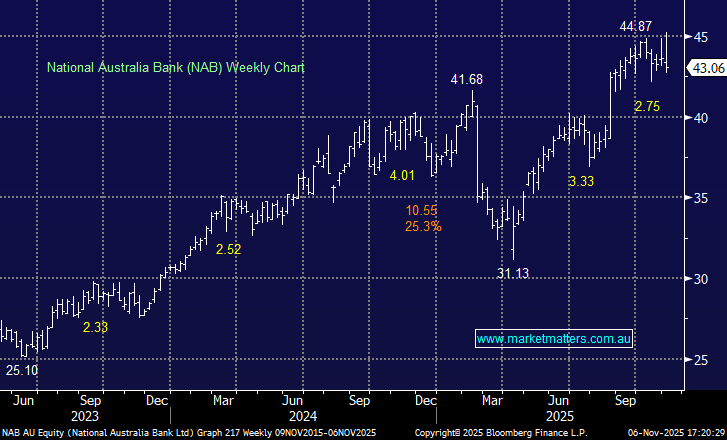

The ASX200 initially ignored a weak lead from US indices yesterday following the Feds announcement that it now expects 2 rate hikes by the end of 2023 – a very logical view in our opinion considering the extremely strong economic recovery over the last year. However a strong Banking Sector was not capable of supporting a market which experienced ongoing selling wash through the Resources Sector as the prospect of rising rates appeared to unsettle investors sending the $US higher and the S&P500 equity futures lower during our time zone. With over 65% of stocks falling the relatively small 27-point decline was almost entirely due to the major banks who managed to buck the trend and rally over +1%.

The reflation trade continued to unwind on Thursday pretty much in line with our morning report, one stock South32 (S32) that we identified as a prime candidate for accumulation by MM has now corrected 10% in just 2-weeks generating the look and feel of a classic crowded trade unwind. Another 4% and this particular stock will be knocking on the door of our buy zone but subscribers should remain mindful of how far we believe the $US can bounce hence we might be patient when pressing the “buy button” but we definitely do intend to increase our exposure to the resources stocks at lower levels.

As we mentioned in our “Match out Report” yesterday Whitehaven Coal (WHC) tumbled over -11% following further poor production numbers, fortuitously MM had trimmed our position from 6% to 4% on Wednesday but almost more importantly to us this was another market move which reinforced our belief that 2021 is year when weakness should be bought and strength often sold e.g. WHC had soared 88% since mid-May. MM continues to believe that the combination of “sell strength & buy weakness” inline with active sector rotation is the key to outperformance over the next 6-12 months.

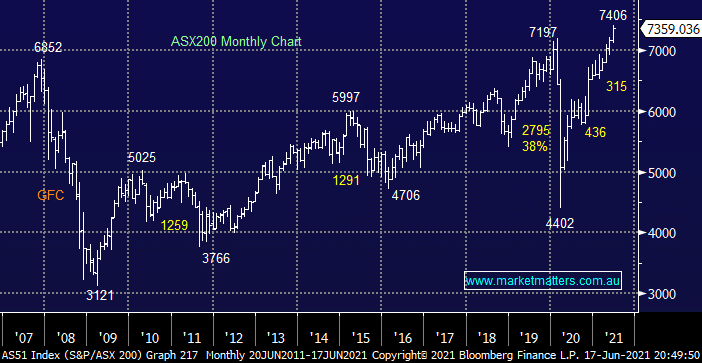

Overnight US stocks closed mixed with the tech sector making fresh all time highs rallying almost 2% whereas the Dow fell 210-points as the financials and resources sectors continue to struggle. The SPI futures are calling the ASX200 to open up +0.5% around 7400 this morning which I feel is a touch optimistic considering the relativcely small tech weighting in our index.