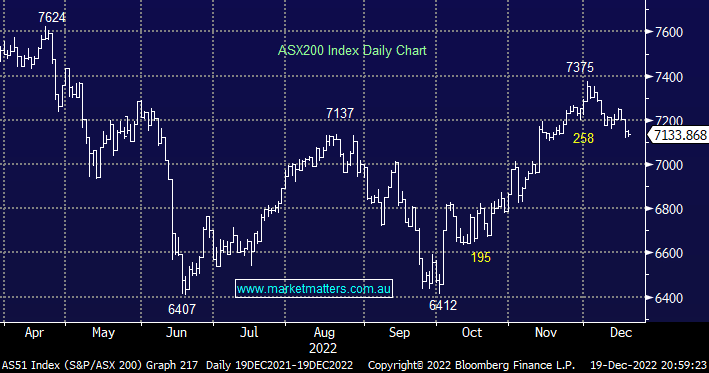

The ASX200 put in a valiant effort yesterday considering Friday’s weakness on Wall Street, for much of the session it actually felt like we were witnessing the dawn of another “Christmas Rally” before the index ultimately closed down just -0.2% with the Real Estate Sector falling -1.1% the weakest link. Conversely, the Energy Sector again rallied solidly led by the coal names with Whitehaven (WHC) now only ~4% away from making fresh all-time highs.

- Forbes magazine wrote last week that there’s a 77.9% chance of a rally this December, with the S&P500 now down -well over -6% so far this month it better start soon!

Elsewhere in financial markets bonds and currencies were both quiet as people appeared to focus on the festive season far more than trying to make a dollar in the last few weeks of 2022. Weakness across Chinese markets was the only noticeable standout as Beijing reported its first 2 Covid deaths – I know I can be cynical at times but 2 deaths due to the Coronavirus out of 1.4 billion people does feel a touch far-fetched even on the most optimistic of metrics.

- If China loses control of Covid it could present some buying opportunities in Q1 of next year albeit for awful reasons.

US stocks fell away again overnight after a firm opening as bonds slipped slightly sending yields higher with the rate-sensitive 2-years back around 4.25%, the Fed’s hawkish comments are looking ever increasingly likely to have denied investors some Christmas cheer. US builder sentiment fell in December to levels not endured in over a decade, outside of the coronavirus outbreak, as rising mortgage rates start to bite – it’s hard to imagine inflation not following in its wake in 2023. The S&P500 closed down -0.9% this morning leading to the SPI Futures pointing to a -0.4% drop by the ASX200 early this morning.

- We feel the ASX200 can regain some recently lost ground into year-end but a test of 7400 now feels too optimistic.