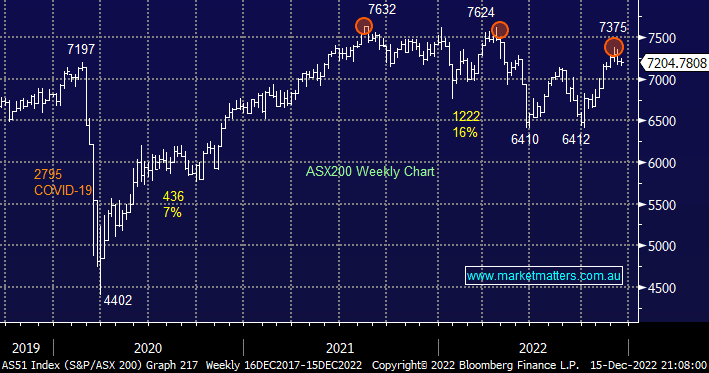

The ASX200 struggled again yesterday taking the market into negative territory for the week as weakness crept into the previously strong Resources Sector. The market has felt heavy over the last few weeks but at this stage, we’re still only -2.3% below the market’s recent high, very surmountable if we can regain our mojo after recent moves by central banks – a big ask this morning! Equities have endured a tough 24 hours after the Fed rebuffed expectations for a more dovish stance, instead, they said interest rates will go higher for longer, to be precise above 5% into 2023. However, we saw some very mixed messages across financial markets post the Fed with the follow-through going to be both fascinating and critical to what the festive season delivers:

- Bonds rallied sending yields and the $US lower e.g. US 10-years closed under 3.5%, well below their October 4.34% high.

- Equities closed lower in a very volatile session with defensives as the best-performing stocks/sectors.

Unfortunately after digesting the Feds hike and message last night all of the above went into reverse which is pointing to a tough start for the ASX this morning. On the macro level, our main concern is that the $US has made fresh 12-week lows this week but the likes of oil and copper have felt tired as they’ve struggled to rally for most of December implying they are already picking a turn i.e. it’s going to be very hard for the ASX to make meaningful gains if the influential resources go into hibernation or worse fall.

US and global stocks were hammered overnight on a wave of central bank rate hikes, with the Fed and ECB both warning that more are likely in 2023. The ECB also lifted its forecasts for inflation into 2024 after its 0.5% hike, conversely, the Bank of England slowed its pace of rate hikes which was interpreted positively as a sign that rates may peak at lower levels than first expected hence the Pound fell and the FTSE outperformed although it still fell -0.9%. Following the S&P500’s -2.5% plunge, the SPI Futures are calling the ASX200 open down around -1.2%.

- We feel the ASX200 can regain some recently lost ground next week but a test of 7400 may now be a step too far.