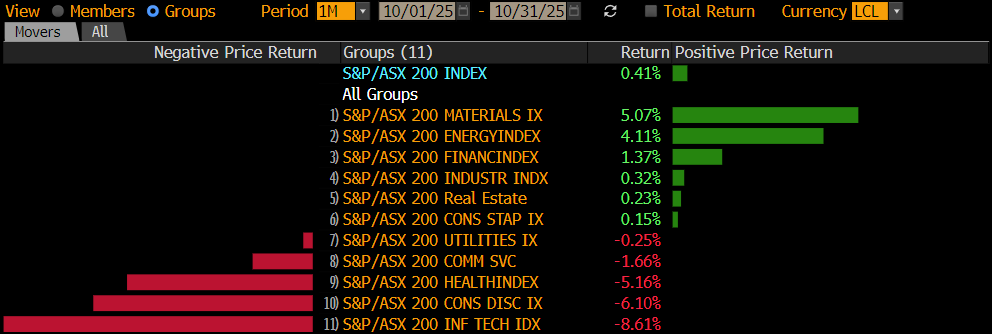

The ASX200 rallied strongly on Wednesday following the positive lead from the better-than-expected US CPI inflation print, we believe bond yields have peaked for now although the Fed have work to do even if the worst of US inflation may have passed. Stocks/sectors are taking some heart from recent Fed comments and Tuesday’s benign CPI read as we see some reversion to the dominant trends of 2022 start to slowly unfold, yesterday fitted into this story under the hood i.e. banks and resources were mixed while the tech stocks gained some traction.

However, while yesterday’s headlines read something like the US CPI only rose 7.1% for November well below the expected 7.3% sending US stocks higher across the board, it wasn’t the full story. Unfortunately, the Dow may have closed up over 100-points but it was up more than 700-points at its best before

fear around the Fed’s looming rate move and arguably, more importantly, rhetoric eased the euphoria ahead of Jerome Powell’s moment in the sun this morning i.e. as MM has been saying since the early October low, “we are bullish equities and buyers of pullbacks but sellers of excessive strength”.

The Fed has a very tricky 2023 ahead of it, they may have hiked rates at an unprecedented rate and have now started moderating their moves from +0.75% to +0.5% but this cannot yet be called a dovish pivot with officials remaining very conscious that inflations running at over three times their 2% goal.

- Overnight the Fed raised rates by 0.5% taking its target range to 4.25% – 4.5%, the second highest since 2007.

- 30 minutes after the Feds move Jerome Powell announced that the Fed sees rates at 5.1% next year i.e. they’re sending a clear message to stocks, don’t get too dovish!

- In other words the market interpreted Powell’s comments as hawkish after the Fed reiterated they remain committed to fighting inflation.

US stocks experienced a wild ride overnight following the Fed’s performance, the broad-based S&P500 finally closed down -0.5% while the SPI futures are pointing to a -0.8% drop early on not helped by BHP Group (BHP) which looks set to open down around 2% today.

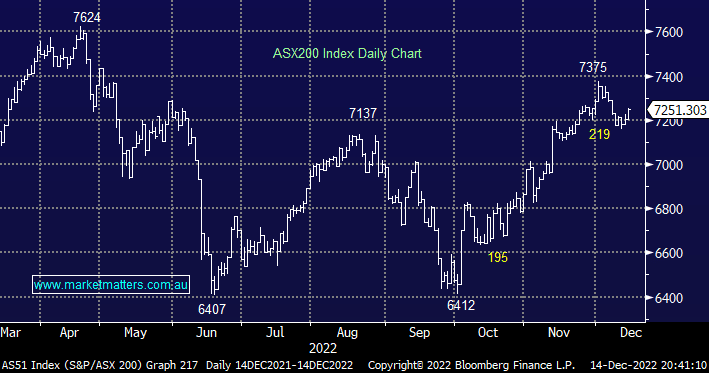

- No change, our preference is the local index will test/break 7400 this month, but the next 48 hours feel critical to this optimistic interpretation.