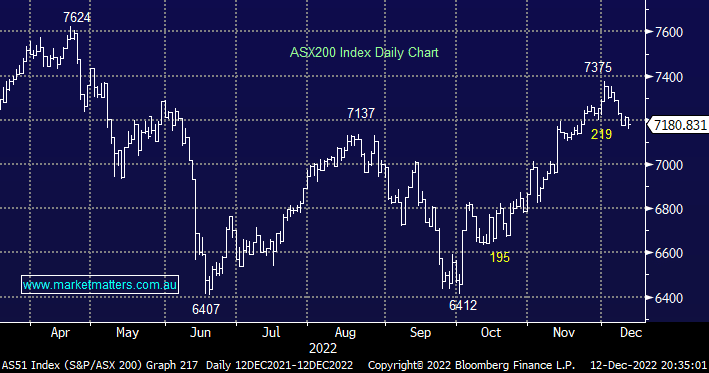

The ASX200 slipped another -0.45% on Monday on broad-based selling which saw well over 60% of the main board close down for the day with the resources coming off the boil catching our attention after we trimmed our exposure last week. Elsewhere in what felt like a fairly quiet day with central banks sitting poised to dominate the news some buying crept into the tech space but there have been many false dawns on this front through 2022:

- Resources: Evolution Mining (EVN) -3.7%, IGO Ltd (IGO) -2.8%, Sandfire Resources (SFR) -1.8% and BHP Group (BHP) -1.5%.

- Tech: Megaport Ltd (MP1) +4%, Xero (XRO) +0.9%, NEXTDC (NXT) +0.4% and REA Group (REA) +0.4%.

The local index has now corrected 3% from its December, and quarter high, and although the markets are clearly nervous ahead of the slew of policy decisions and economic data out this week from a seasonal/statistical perspective MM would be reticent to be too negative stocks with only 9 trading days for the ASX before Christmas Day i.e. I’ve seen stocks feel like this before in December only for the sellers to vanish almost across the board and the path of least resistance suddenly becoming one way north.

European stocks retreated overnight as people felt comfortable on the sidelines ahead of interest rate decisions on both sides of the Atlantic with miners and retail sectors both lower as they were on the ASX. At this stage, the Fed is expected to hike by 0.5% on Wednesday but Tuesday’s inflation data still has the potential to change the opinion of traders. US equities managed to rally overnight courtesy of gains in the tech and energy names, the S&P500 closed the session up +1.4%, and the SPI Futures are pointing to an early +0.7% gain by the ASX200 this morning regaining more than yesterday’s losses in the process.

- No change, our preference is the local index will break/test 7400 this month but we do feel the risk/reward has diminished following the market’s 15% rally from its October low.