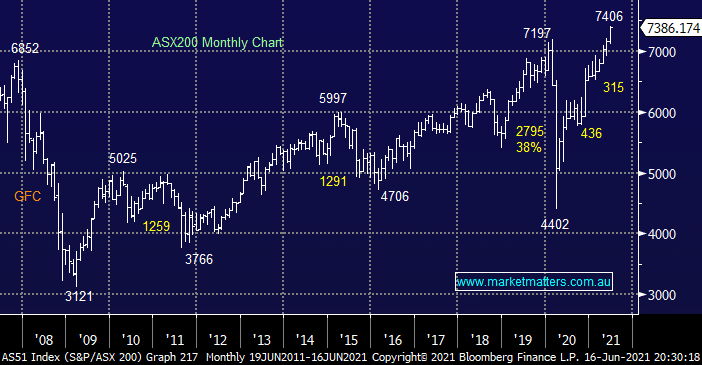

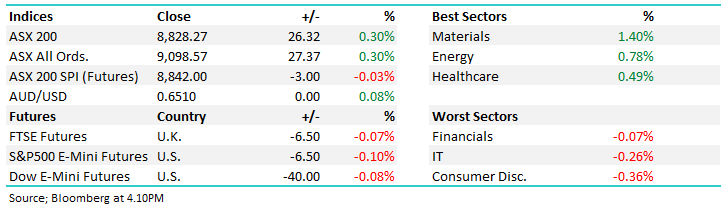

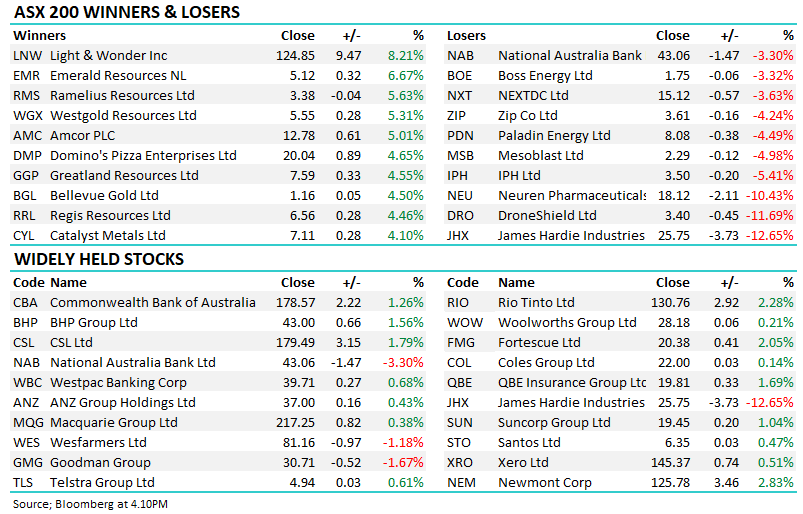

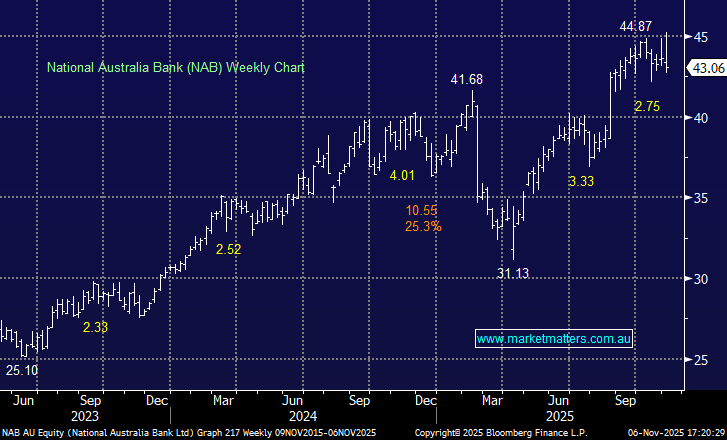

The ASX200 continues to grind higher and although it only closed up 6-points yesterday it was the first time we broke above the psychological 7400 barrier as the banks, and especially CBA, continue to rally strongly. Wednesday actually saw more stocks close in negative territory but as we’ve said previously when the “Big Four Banks” rally and they’re supported by CSL Ltd (CSL) most of the time the local markets likely to advance. The Resources Sector was the markets weakest link following the overnight plunge in copper which had many questioning if the reflation trade had become too crowded – we believe it has.

Interestingly the latest Bank of America Funds Managers Survey which came out this week agrees with us on this one, it’s refreshing not to be in the contrarian corner, at least for now:

- Over 70% of US fund managers believe the recent kick up in inflation is temporary implying rates / yields aren’t going significantly higher in 2021/22.

- The managers believe the resources sector has become the most overcrowded trade, taking over from crypto Bitcoin which has subsequently crashed – were a keen buyer of the Australian miners into weakness.

- Investors remain bullish with cash levels falling below 4% which tells us investors are long / almost fully invested hence when we do get the next pullback it be could hard & sharp in nature as opposed to a slow grind lower.

- Bond allocations have been cut to a 3-year low which makes sense because its hard to envisage bonds rallying / intertest rates falling as the post COVID economic recovery gathers momentum.

NB The BofA survey is produced by over 220 professional fund mangers who currently manage ~$860bn.

Overnight US stocks were hit pretty hard following the FOMC Meeting which flagged 2 rate hikes by the end of 2023. The S&P500 slipped -0.5% but the SPI Futures are again calling the ASX200 marginally higher with a weaker $A potentially attracting some offshore buying.