The ASX200 fell another -0.7% on Thursday dragged lower by broad-based selling and specific weakness across the influential banks and large-cap miners. A combination of the RBA hiking rates at the same time as growth data has started to soften has weighed on already nervous growth names while the China reopening play has started to lose momentum after pushing our Resources Sector significantly higher over recent weeks.

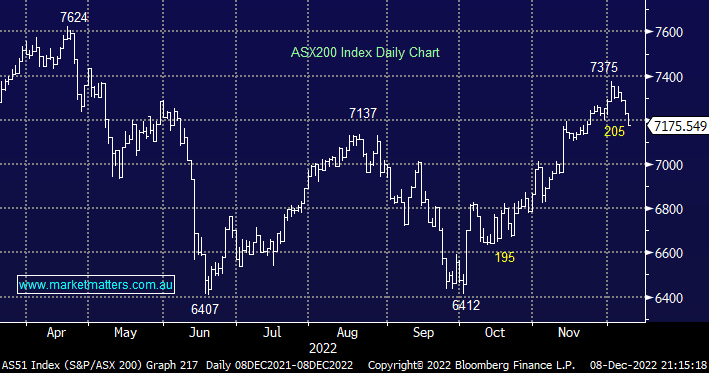

Since the RBA’s 0.25% rate hike on Tuesday local equities have “felt heavy” as they’ve rapidly pulled back over 200-points, if the market follows the usual seasonal playbook its time to start looking for a December low before making a final assault on 7400 helped by a dearth of selling into Christmas. Yesterday MM increased our cash holdings across 3 of our portfolios in case this last chapter for 2022 fails to materialise, after all, it has been a year of general disappointment.

US equities bounced overnight although a bounce by bond yields capped the gains with tonight’s Producer Price Index (a precursor to inflation data next week) which is likely to have a significant impact on sentiment into Christmas and the Feds policy meeting on the 13th & 14th. The SPI Futures are pointing to a +0.5% open this morning following the firm night on Wall Street e.g. Tech based NASDAQ up +1.2%.

- No change, our preference is the local index will break/test 7400 this month but we do feel the risk/reward has diminished significantly after the market’s 15% rally from its October low.