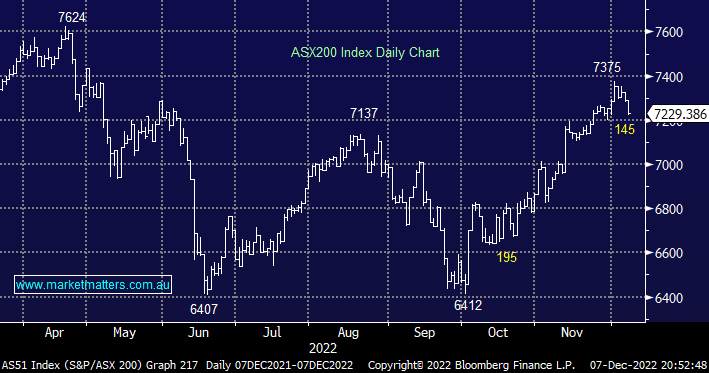

The ASX200 experienced a tough Wednesday finally closing down -0.85% after a huge sell order hit the SPI futures market after 4 pm, ultimately it doubled the day’s losses in just 10-minutes i.e. before the aggressive MOC Order (market on close) the index had clawed back from being down 70-points to being just 32-points in the red. The market was feeling reasonably constructive into 4 pm but alas big MOC sell orders are often a sign equities have lost their mojo, at least for a while, remember in Wednesday’s Portfolio Report after the RBA’s 8th consecutive rate hike we wrote – “Considering how far local stocks have rallied from both their October low and overall proximity to an all-time high we feel it’s likely they will struggle over the coming sessions.”

- Over 5000 SPI traded between 4 pm & 4.05 pm before things quietened down before the markets 4.10 pm “Match Out”.

- A 5000 lot sell order in the SPI is equivalent to a more than $900mn basket of stocks being sold into the market in just 5 minutes i.e. 7250 x 25 x 5000.

Fortunately for the local index’s sake, the Resources Sector remains firm but as we’ve seen with other pockets of the markets when investors decide to take some profits it can be in an almost stampede-like fashion hence MM is watching our exposure to the likes of BHP Group (BHP) and Sandfire Resources (SFR) very carefully as the market starts to “wobble” into Christmas – alerts are likely to be forthcoming.

US equities experienced a quiet directionless session overnight with the indices chopping around unchanged before finally closing mixed, the SPI Futures are pointing to a small -0.2% dip on the open this morning.

- Our preference remains that the local index will break/test 7400 this month but we do feel the risk/reward has diminished significantly after the market’s 15% rally from its October low.