The ASX200 rallied another +0.3% on Monday courtesy of China’s reopening shift which propelled resource stocks higher on hopes that the global economy can avoid a deep contraction in 2023, unfortunately, the move caused the market to polarise as bond yields rallied in line with the optimism towards the growth outlook. The move in bonds resulted in over half of the market closing lower but when the heavyweight resources advance strongly the market often ignores the crowd:

Winners: Fortescue Metals (FMG) +6.98%, RIO Tinto (RIO) +3.7%, South32 (S32) +3.6%, Sandfire Resources (SFR) +3.2% and BHP Group (BHP) +2.3%.

Losers: Utilities, Industrials, Healthcare, Financials and IT – however only the ESG names endured meaningful losses e.g. Pilbara (PLS) -5.1% and IGO Ltd (IGO) -4.9%.

As we’ve mentioned a few times in recent reports the RBA will take centre stage today at 2.30 pm, the markets looking for another 0.25% hike taking rates up to 3.1%, MM believes there’s a very good chance they will leave it alone and reassess in February. Time will obviously tell but we feel it makes sense to remain flexible in Q1 of 2023, hiking today is unlikely to change many people’s spending habits into Christmas.

- We believe there’s a strong possibility the RBA leave rates at 2.85% or will play the “Clayton card” and go just 0.15% – if we are correct the ASX200 is likely to react favourably this afternoon.

US equities experienced a tough session overnight as bond yields went up after the US services gauge surprisingly rose causing concern the Fed would maintain its aggressive fight on inflation, the move in yields pushed the $US higher which in turn weighed on commodity prices. Losses were broad-based with ~95% of the S&P500 retreating, the path of least resistance clearly felt on the downside after the recent solid gains by equities. The Dow closed down 482 points and the SPI Futures are pointing to a -0.6% drop early this morning by the ASX200.

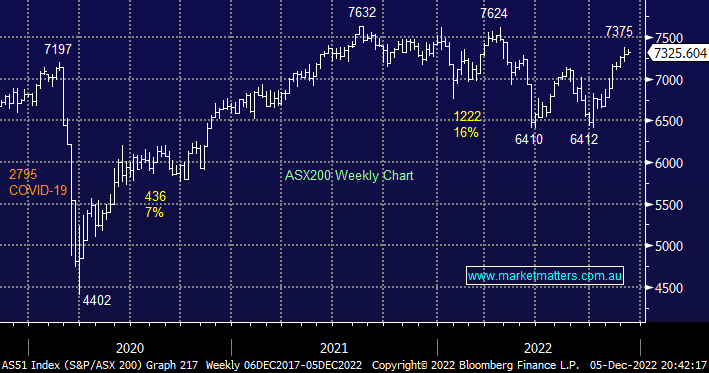

- We remain cautiously bullish on the ASX200 into Christmas but we feel the “easy money” is behind us on the index level it’s not necessarily the case for specific stocks/sectors.